In Fake Culture War, House Republicans Vote to Ban Retirement Plans From Considering ESG Investments

Republicans are targeting a Labor Department rule that allows (but does not require) retirement plans to take into account environmental, social, and corporate governance.

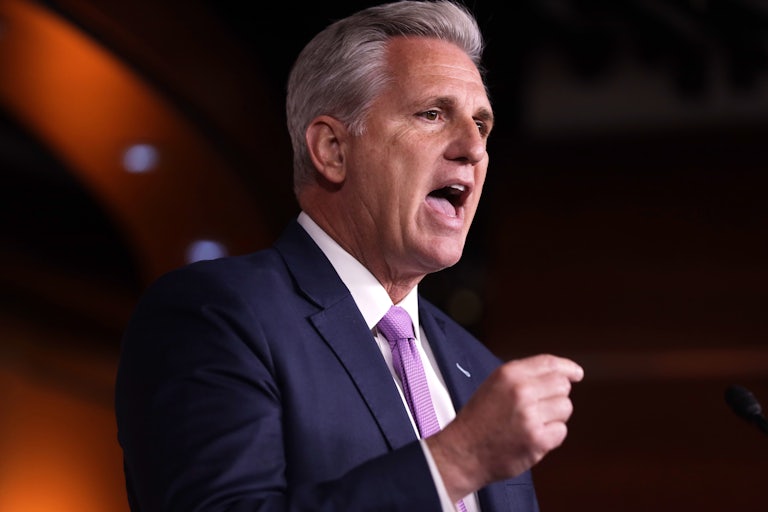

The House of Representatives passed a bill Tuesday blocking the Labor Department from implementing a rule that encourages retirement plans to consider environmental, social, and corporate governance, in Republicans’ latest manufactured culture war.

Representatives voted 216–204 for the measure, mostly along party lines. Only one Democrat, Maine Representative Jared Golden, voted for the measure, which now goes to the Senate. President Joe Biden has said he will veto the bill if it makes it to his desk.

Environmental, social, and corporate governance, or ESG, is a framework that helps investors understand how an organization—in this case, retirement savings plan managers—manages risks and opportunities regarding sustainability. Issues of sustainability include environmental protection, impact on society, and aligning corporate leadership goals with stakeholder ones.

The Labor Department rule makes it easier for retirement plan managers to consider ESG factors such as climate change when making investments or voting on behalf of shareholders. It does not actually require the plans to include these considerations, making it clear Tuesday’s vote was just another Republican attempt to fearmonger over something that’s really not bad.

Republicans have slammed the rule as another facet of “woke capitalism.” The GOP has declared war on “wokeness,” meaning anything that has to do with social equity or change. Last week, Vivek Ramaswamy, a prominent critic of ESG investing, announced he is running for president in 2024. Florida Governor Ron Desantis, another likely Republican presidential candidate, also proposed banning ESG investment in the state earlier this month.

Senate Minority Leader Mitch McConnell said the House bill would make sure retirement plan managers only consider financial returns on investments, instead of “extraneous factors” such as climate change and employment policies.

“Democrats want to let money managers make these unrelated ideological goals a higher priority than getting their clients—ordinary American workers—the best returns for their own retirements,” he said on the Senate floor Tuesday. “I’ll be proud to support this commonsense measure later this week.”

The bill now goes to the Senate for a vote, where all Republicans and Democratic Senator Joe Manchin support it. The measure needs only a simple majority to pass, and with Senator John Fetterman out getting treated for depression, it is likely to get through.

House Democrats, meanwhile, have introduced a competing bill called the Freedom to Invest in a Sustainable Future Act. The bill would codify retirement plan managers’ right to consider ESG factors when making decisions. It is unlikely to get the support it needs to pass the Republican-controlled House.