When the Titanic crashed into a wall of ice at 11:40 p.m. on April 14, 1912, it had been warned seven times about the danger that lay waiting ahead. Yet those in charge did not alter course. When the ship hit the iceberg as predicted, the crew had mere minutes to concoct a plan capable of redeeming even some of that lost time. Their efforts were not wholly in vain; nearly a third of the passengers survived—famously, the wealthiest ones.

What if, instead of all that last-ditch lifesaving, the ship’s company had decided to maintain its hubristic denial? Imagine if the crew had spent their final hours reviewing documents about the legality of putting passengers into lifeboats. Or if they had looked wistfully at the emergency vessels stored on the boat deck, only to decide using them wasn’t worth the ire of the highly litigious, anti-lifeboat political bloc. Imagine if they had wasted even more time. No one would have lived to tell the tale.

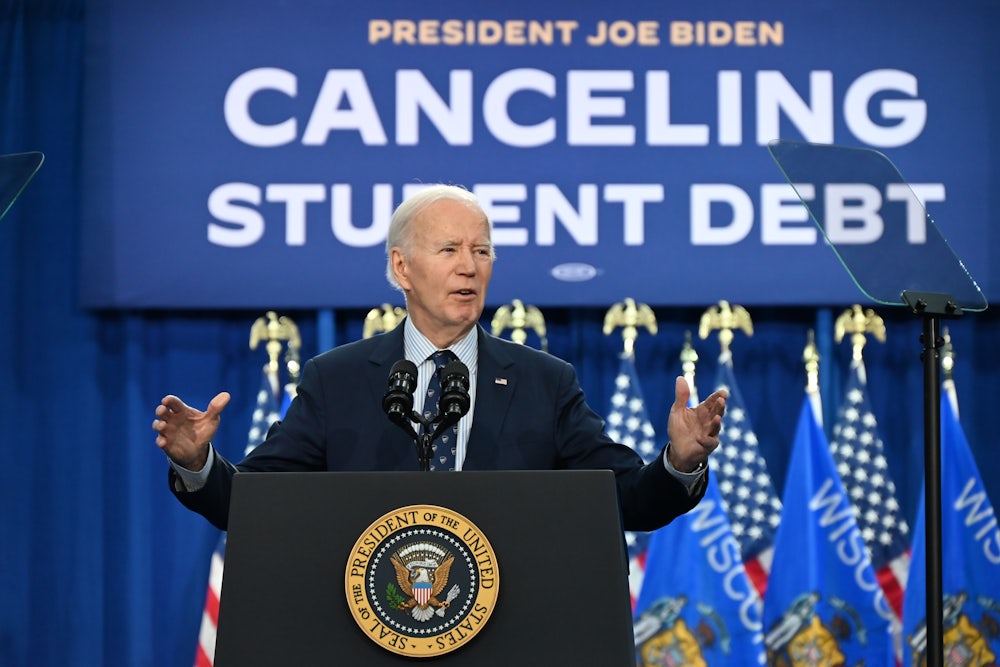

The Biden administration is facing its Titanic moment of student debt cancellation. Trump’s plan for the Department of Education and his designs to abort all student debt cancellation will be, effectively, an existential iceberg for 40 million student debtors and their families, one that will sink even long-standing relief programs, including public servant loan forgiveness and income-driven repayment programs. The incoming administration has no interest in abolishing student loans. They want to abolish the Department of Education.

But right now, in true Titanic fashion, the only lifeboat that has been launched is a pardon for the president’s son, Hunter Biden. Meanwhile, reporting suggests that Democratic Party loyalists, including Liz Cheney, may soon be preemptively buoyed by similar blanket amnesty. South Carolina Representative Jim Clyburn, who apparently has soured so much on accountability that he’s prepared to co-sign the incoming administration’s impunity, has even suggested that some of Biden’s few remaining days should be spent pardoning Donald Trump—who’s already safely floating away from legal repercussions on a lifeboat provided by the Supreme Court.

What about everyone else? Wiping out student debt would be one way for the administration to put masses of ordinary people into lifeboats. As the Biden administration has proudly touted, student loan cancellation transforms people’s lives for the better. It enables them to buy homes, start families, retire from bad jobs, and pursue more meaningful occupations. It improves people’s physical health and boosts mental well-being. Under the Biden administration, roughly one in 10 debtors have had some or all of their loans discharged. But millions more are waiting with bated breath for the respite they were promised. And despite the actions of a hostile, ultraconservative Supreme Court, the president still has the power to deliver on his commitments. The secretary of education could approve the millions of stalled applications for Public Service Loan Forgiveness—while there is still a public sector to employ people. Biden could also order the cancellation of federal loans for older borrowers, people in long-term default, and the victims of predatory for-profit colleges.

For millions of older borrowers, these next few weeks likely present their last shot to be freed of crushing debt. Many of these debtors have more than paid back their original sum, but compounding interest and faulty relief programs keep them financially trapped. Seniors’ limited earnings correspond with high rates of default; for most, repayment is not a possibility, and many have their Social Security garnished as punishment, which makes life on a fixed income all the more challenging.

The responsibility for what comes next is not just on President Biden, who has long appeared asleep at the ship’s helm. White House officials, including Chief of Staff Jeff Zients and Domestic Policy Council director Neera Tanden, as well as Education Secretary Miguel Cardona and his Undersecretary James Kvaal, have ample power to influence policy. But they have yet to use it.

Unless these individuals act swiftly, millions of borrowers will die buried in debt. One such person is 77-year-old Gail Gardener. It took Gardener nearly 20 years to complete her bachelor’s degree, taking one class at a time, as a working, single mother. She eventually got a master’s degree, and became a high school English teacher in Florida, where she introduced generations to the wonders of Zora Neale Hurston, The Odyssey, and spoken word.

But when Gail was 41 years old, she experienced a life-changing horror: A stranger broke into her home and raped her. The incident prompted Gail to see a therapist, who worked with Gail to address deep childhood trauma; for the first time, Gail began speaking up about the sexual abuse she had suffered as a child, and she was determined to help others break their silence. So, at age 63, Gardener borrowed $20,000 in student loans and enrolled in an online program in pastoral counseling from Liberty University, Jerry Falwell’s college.* Gail now owes nearly $550,000 for the privilege of working in a healing profession. “Paying it down is never going to happen,” she told us.

In September, a group of older student debtors, including Gail, went to Washington D.C., to call on lawmakers to erase their loans. It was the first time a mass action for debt relief was led by elders. Death, they argued, should not be their only relief option—particularly when Section 902.2 of the congressionally approved Federal Claims Collection Standard Act permits the Department of Education to discharge loans held by older borrowers. On December 11, many of these borrowers will return to Washington to make a final plea: that Biden use his authority to free aging debtors before it’s too late.

Meanwhile, there are other lifeboats Biden can fill, and debtors and their congressional allies are imploring Biden officials to use them. For example, the Department of Education could zero out all accounts in long-term default. Default tends to correlate with extreme financial distress. Many defaulters were not able to finish their degree programs; they have the burden of debt without the benefit of a diploma. There’s no reason for the government to waste precious resources trying to squeeze money from proverbial stones. If this were any other kind of personal debt, these borrowers would have the ability to declare bankruptcy. But student debt lacks such protections, thanks in part to Senator Joe Biden’s 2005 work to exclude student debt from bankruptcy protections. Canceling long-defaulted debts would be a major step toward repairing this harmful legacy.

The president could also swiftly protect the millions of borrowers who attended predatory, for-profit scam schools. Anyone who attends a school that lies to them or breaks state law is eligible for federal loan relief under existing rules. Last week, 72 representatives signed a letter led by Senators Edward Markey and Dick Durbin calling on the administration to issue group discharges for these debtors without delay. “You can’t go back to Delaware until you get this done, buddy,” Senator Durbin said, directly addressing Biden at a press conference.

As the letter notes, the Department of Education is sitting on a backlog of applications submitted by students who were scammed by a wide range of predatory schools. These include Brooks Institute, Kaplan University, Grand Canyon University, DeVry, University of Phoenix, and a hundred others. There’s no time to process these claims individually. And there is no reason to bother to try: Group discharges have become standard practice in recent years and the Department possesses mountains of evidence detailing systemic fraud and abuse by these companies. What are they waiting for?

Consider Valerie Scott, who owes $389,000 after attending Argosy University with the goal of becoming a psychologist. Scott, like so many other victims of for-profit diploma mills, was subjected to high-pressure marketing and recruiting tactics and misleading claims about cost of attendance and job placement rates. She earned what she calls a “junk degree” and, lacking other career options, eventually joined the military.

In 2019, the school was forced to close due to mismanagement and embezzlement of federal student aid dollars. Yet thousands of students just like Scott are still on the hook for money wheedled from their wallets by predators. They have put off medical care, been unable to save for retirement, had vehicles repossessed, and even experienced homelessness as a result of their Argosy debt. Granting relief to borrowers like Scott is not “forgiveness,” it is basic justice rooted in respect for existing laws written to protect vulnerable students from corporate greed and misconduct.

These laws, which have gathered so much dust under Democratic leadership, may not survive the next four years. However hostile to public education the incoming Trump administration might be, Trump will be a faithful friend to the for-profit education sector—con men of a feather, flocking together. Stocks of for-profit institutions are already rallying in anticipation of diminished regulatory scrutiny. Trump’s previous education secretary, billionaire heiress Betsy DeVos, did everything she could to sabotage student loan relief and aid education profiteers. Her likely replacement, World Wrestling Entertainment executive Linda McMahon, has little public policy experience and strong corporate ties, as well as a troubling record of defending sexual predators in order to protect her own businesses’ bottom line. Her foremost credential is loyalty to a president who proudly ran his own fraud-plagued education racket, Trump University.

As we race toward an authoritarian iceberg clearly aimed at crushing vital government programs and agencies, Biden has a choice: He can act swiftly to save lives or wring his hands and abandon the people he pledged to serve. The more student debt Biden cancels in the coming months, the more lives he will save, plucking them from the harm and chaos Trump and his allies have promised. The Trump administration has shown us who they are and what they intend to do. We believe them. But for the next 50 days, Joe Biden is still the president. As such, he still has great responsibility on his hands, and a singular choice: To do everything he can to save lives, or to concede to the cowardice of false powerlessness.

It is not yet clear how history will judge the policymakers—Joe Biden, Neera Tanden, Jeff Zients, Miguel Cardona, James Kvaal—who currently have power to save lives. Will they do everything they can to load up the lifeboats or will they dither until the clock runs out? If you have steered your vessel into perilous waters, do you have an obligation to rescue the drowning? What is your legacy if you refuse to try?

* This article originally stated that Liberty was a for-profit institution.