If you’re looking to buy a Tesla, you’re in luck—some of its models are suddenly a lot cheaper. Since the beginning of the year, Tesla has gradually dropped the price of its Model X by $41,000; you can now buy one for just $79,990, following another $8,500 cut last week. Conveniently, that puts that car and two other models just within range to qualify for the $7,500-per-car tax credit furnished by the Inflation Reduction Act, or IRA, which cuts off for trucks and SUVs that cost more than $80,000 and cars over $55,000.

Taking advantage of federal subsidies isn’t new ground for automakers. But Tesla’s volatile CEO has a history of very vocal opposition to these subsidies and the governments that pass them—all while building an empire off the federal largesse provided to his companies. As Elon Musk becomes deeper and deeper entrenched in culture wars and contrarian politics, he’s warmed to policies passed by a Democratic Congress that stand to make him even richer.

The road to Tesla taking advantage of this particular subsidy was a long and rocky one. “I’m literally saying, get rid of all subsidies,” Musk said at a Wall Street Journal conference in December 2021, as the bill that eventually became the IRA made its way through Congress. “We don’t need the $7,500 tax credit. I would say, honestly, I would say I would just can this whole bill. Don’t pass it,” he added, citing concerns about the deficit. He also criticized (eventually nixed) proposals to offer bigger incentives to companies that build their cars with union labor, which Tesla does not.

Tesla had been eligible for pre-IRA tax credits for electric vehicles before surpassing a 200,000 vehicle limit per manufacturer in 2020. New IRA subsidies lifted that cap but placed more stringent limits on which vehicles qualified; before this winter, Teslas were too expensive.

A few months after that package passed, however, Tesla executives signaled that the company was indeed looking forward to taking advantage of new credits for cars and battery storage. CFO Zachary Kirkhorn called the IRA “a significant boost towards accelerating our mission.” Just weeks after disparaging the E.V. credits to Senator Lindsey Graham, Musk said on an October 2022 earnings call that the company expected “to fully meet the IRA’s requirements.” Tesla started slashing prices accordingly after the bill took effect in January, making versions of its Model Y SUV—and now Model 3 and Model X—eligible for credits.

Following these changes, Musk has, accordingly, changed his tune on E.V. incentives in recent years. This spring, he called the IRA itself “very well-written” and said the tax credits were helpful.

That’s likely less of a philosophical shift than a practical one. As more companies look to take advantage of U.S. incentives to make E.V.s—and respond to policies to phase out gas-powered vehicles abroad—Tesla faces increasing competition from legacy automakers offering electric versions of beloved models like the F-150. Balking at the tax breaks their competitors are raking in could leave the company playing catch-up. Tesla’s website now prominently advertises the models that qualify for the federal tax credits.

For all Musk’s protests, initiatives passed by the Biden administration have made a nice profit for his companies. In June, researcher Benchmark Mineral Intelligence found that Tesla was poised to rake in $1.8 billion this year from the IRA, well above the windfall expected by Big Three automakers Ford and General Motors. The company could stand to make $42 billion by the end of 2032. Musk will benefit too from money provided by the Bipartisan Infrastructure Act for electric vehicle charging stations, where Tesla may well be en route to a monopoly. SolarCity, acquired by Musk in 2016, will see obvious upsides from the IRA’s generous tax incentives for solar.

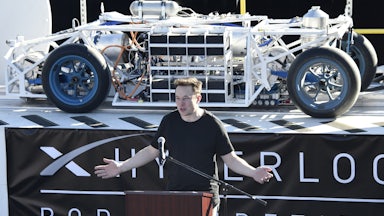

Those benefits from the IRA, though, are just a small chunk of the many ways Musk’s fortune is premised on public money. Early on in Musk’s involvement in the company, Teslas received a $465 million loan guarantee through the American Recovery and Reinvestment Act, repaid in 2013. SpaceX, now valued at around $150 billion, has inked expansive contracts with the U.S. government, worth $15.3 billion since 2003. The company was buoyed by a crucial NASA contract as it sputtered in 2008.

Musk’s ubiquity in strategic sectors has allowed him to amass an enormous amount of sway with federal officials. As Ronan Farrow recently reported in The New Yorker, the U.S. government leans heavily on Musk to run core parts of its support for the war in Ukraine. SpaceX’s Starlink satellite network has been the key means by which fighters have communicated on the front lines of the war there. Yet Musk’s control of the company—and seeming affection for Vladimir Putin—has left policymakers trying to appease his ego, Farrow notes. That influence is much more expansive, however. “Current and former officials from NASA, the Department of Defense, the Department of Transportation, the Federal Aviation Administration, and the Occupational Safety and Health Administration,” Farrow writes, “told me that Musk’s influence had become inescapable in their work, and several of them said that they now treat him like a sort of unelected official.”

Musk’s antics on the site formerly known as X—from his love of mid-2000s internet humor to far-right conspiracy theories—can cover up just how much of the future is being ceded to him. It also points to a key tension within Bidenomics, premised as it is on using public funds to unlock private-sector investment in the industries the White House sees as essential to U.S. economic competitiveness in the twenty-first century. As of now, its key mechanism is turning on the spigot for chosen sectors. Like any good corporate titan, Musk will lap up those funds wherever he can, however critical he might be of the policies that built his empire online.

There are obvious dangers in entrusting important issues of national security and climate policy to a mercurial, addled billionaire; will he shut down E.V. chargers like he has Starlink satellites? Beyond Musk is the larger question of whether the United States will maintain its hands-off approach within the industries it hopes to grow. Will policymakers continue to trust CEOs like Musk to make key decisions over how and how quickly the U.S. decarbonizes or start treating him like the vampire squid he is?