Global Economic Group Has Dark Warning About Trump’s Tariffs

Donald Trump’s tariffs aren’t only going to hurt the U.S. economy.

Donald Trump’s sweeping tariffs will lead to a “significant slowdown” in global growth, the International Monetary Fund said Tuesday.

The fund said that Trump’s “reciprocal tariff” policy, announced earlier this month—which placed at least a 10 percent tariff on nearly every import to the United States—would hurt everybody, the U.S. and its trading partners alike. “This on its own is a major negative shock to growth,” the IMF said of Trump’s “Liberation Day” tariffs, in the executive summary of its April 2025 World Economic Outlook.

The U.S. now faces a depressed growth forecast in 2025, down to 1.8 percent from 2.7 percent in January, according to the fund. The IMF’s chief economist, Pierre-Olivier Gourinchas, told reporters that the odds of a recession in the U.S. had increased from 25 percent in October 2024 to 40 percent. He said that the tariffs are a “negative supply shock for the economy imposing them.” Efforts to stymie inflation would also be undermined, the fund said.

The fund warned that the president’s radical reshaping of the U.S. economy would sink global economic expansion to an annual rate of 2.8 percent, a whopping half percentage point below what was projected in January. That rate is likely to rebound to 3 percent in 2026, but it would still be well below its average of 3.7 percent.

“The landscape has quickly changed,” said Gourinchas. “We are entering a new era as the global economic system that has operated for the last 80 years is being reset.”

The IMF serves as a lender of last resort for poorer governments, and has been the subject of some criticism over the terms of its debt-restructuring agreements, which demand austerity and privatization from borrower countries.

This newest economic outlook projection flies in the face of Trump’s repeated claims that his flurry of tariff announcements would make everyone rich, boosting the U.S. economy by crippling global supply chains to somehow promote domestic manufacturing.

Already, the effects on U.S. assets are pronounced. The stock market dropped yet again on Monday, the yield on a 10-year Treasury note rose to 4.89 percent, and the ICE U.S. dollar index—which measures the dollar against foreign currencies—sank more than 1 percent to its lowest level since March 2022. Trump has continued to level attacks on Federal Reserve Chair Jerome Powell, who last week predicted that the president’s tariffs would cause inflation to rise, and refused to cut interest rates.

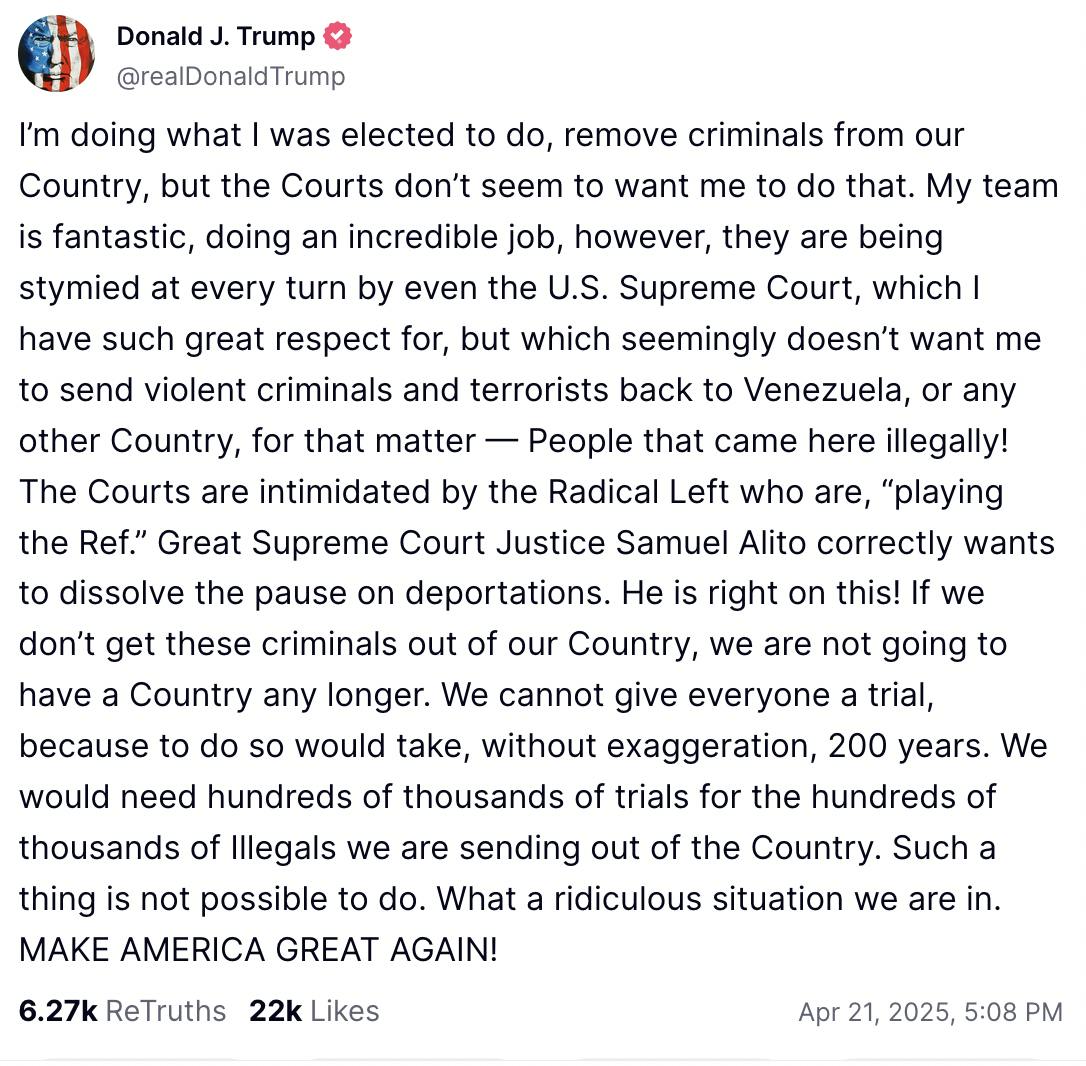

“THE BUSINESSMEN WHO CRITICIZE TARIFFS ARE BAD AT BUSINESS, BUT REALLY BAD AT POLITICS,” Trump wrote on Truth Social Sunday. “THEY DON’T UNDERSTAND OR REALIZE THAT I AM THE GREATEST FRIEND THAT AMERICAN CAPITALISM HAS EVER HAD!”