Hey, Democrats—Here’s a Winning 2024 Message on a Silver Platter

Why the party should go big on protecting consumers from corporate crooks

I’m not the sort of person to wager money on Supreme Court rulings based on the tenor of oral arguments, but TNR contributor Matt Ford was one of many high court observers who thought there was reason to believe the Consumer Financial Protection Bureau—which has served as an advocate for ordinary Americans against a slew of fast-fingered corporate crooks—may just survive its day in court. Should the CFPB prevail, it will buck some significant trends: one being the recent Supreme Court’s antipathy toward Democratic governance and the administrative state in general, the other being the longer-running winning streak that corporate interests have enjoyed at the high court for as long as anyone can remember.

But whether we’re poised to celebrate the CFPB’s unlikely survival or soon to mourn its demise, it’s worth reflecting on the agency’s mission and urging Democrats not just to continue it but to make the idea of protecting ordinary people from corporate thieves and cheats even more central to the party’s identity. Obviously, that work will only be more difficult if the CFPB goes down—should the Roberts court do the deed, liberals must add its demise to the larger portfolio of complaints that have driven public esteem of the court to new lows. But even if it emerges unscathed, a passion for protecting the little guy from a universe of crooks should be fomented and channeled with renewed vigor, as should a commitment to making consumer protection a vital avenue of the party’s policymaking zeal and its political fury.

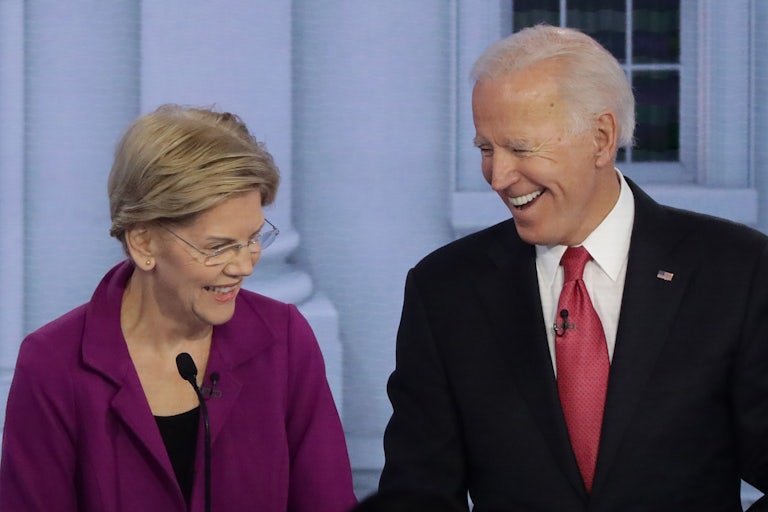

As the Public Interest Research Group recently recounted, the CFPB has some hefty accomplishments to its name. The agency, which is often referred to as Elizabeth Warren’s brainchild, has recouped $17.5 billion worth of consumer money. This year alone, it’s prevailed against a slew of foes, from big banks to shady data brokers, and offered guidance to help ordinary people avoid pitfalls and hang onto their hard-earned money. These are victories that Democrats should savor and tout, in the same way cops do when they force scofflaws to do a public perp walk, their seized assets left on a table as Instagrammable trophies.

There’s a simple idea here: It should be politically toxic to rip people off. One suspects that everyone who opposes the CFPB’s mission is aware of how it looks to throw in with plutocratic con men, which is probably why Big Business has confronted the agency in crab-walk fashion, sidling up to the supposed cracks in its constitutional edifice rather than challenge it frontally by going to bat for every unreliable fiduciary and financial scam artist in Christendom.

It’s somewhat significant that in this most recent case, it’s the ultimate financial bottom-feeders serving as plaintiffs: payday lenders, who I once described as being fit for only two purposes—“to encircle the working poor in inescapable cycles of crushing debt, and to continually generate plausible-sounding reasons for why a civilized society should continue to allow [them] to exist.” I suppose you can add “front-running for the entire financial services sector against the country’s consumer watchdog” to that brief—an advantage seized from having a toilet reputation in the first place.

Democrats, of course, haven’t always walked the right side of the street where consumer protection is concerned. Scofflaws of all varieties, from payday lenders to big banks, have found allies on the left side of the aisle far too often. This needs to change: The CFPB is an important part of the Democratic Party’s legacy. The taxpayers who ponied up billions of dollars to bail out the banking industry after the 2008 financial crisis got little thanks and almost nothing in return for their generosity. The CFPB is the only monument to their sacrifice; the only gift they got in return.

This is a ripe time to renew this past promise. Democrats will go into the 2024 election seeking once again to define Trump as an illiberal force bent on soiling our civic fabric, thus building on the pro-democracy message of the 2022 midterms—which pundits pooh-poohed but voters embraced. Democrats will also likely make hay out of the GOP’s antipathy to abortion rights and the post-Roe dystopia it engendered and is now trying to avoid talking about. But there’s room for Democrats to diversify their portfolio of enemies, and consumer protection allows them to take on targets that are less partisan but just as political—adding some “right versus wrong” to a message that’s already full of “left versus right.”

Moreover, consumer protection is a cause that provides ample opportunity to freeze Republicans in disadvantageous positions: It’s pretty effective politics to campaign against the crooks who are plundering everyone’s American dream one dime at a time. If Democrats invite Republicans to weigh in on whoever ends up in the consumer protection crosshairs, they can either agree and help Democrats forge bipartisan consensus or they can disagree and get implicated as enablers. Democrats can tether their consumer protection zeal to their pro-democracy arguments as well: Certainly the clear consequences of a Trump win will be an executive branch that’s not just hostile to consumer interests but likely to pervert the cause of consumer protection as a weapon against its political enemies.

As former TNR contributor Brian Beutler noted, in a recent edition of his Off Message newsletter, Democrats have recently struggled to recover the “confidence and combative energy they’d developed by the end of George W. Bush’s second term,” their “fighting spirit” replaced by a data-driven, poll-tested “spirit of timidity.” Well, the quickest way to get back in the ring is to start naming foes and picking fights. President Joe Biden has seeded the terrain by making the purveyors of junk fees one of his administration’s enemies. But this is a fun fight everyone should join.

This article first appeared in Power Mad, a weekly TNR newsletter authored by deputy editor Jason Linkins. Sign up here.