The Headwinds Facing Offshore Wind Farms

What’s the big holdup?

Last week, the Biden administration held the nation’s first ever offshore wind auction in the Gulf of Mexico. It described the sale in a press release as part of its “once-in-a-generation investment in America’s infrastructure and our clean energy future,” with the potential to power around 1.3 million homes with clean energy. A significant sale could have signaled a shift away from fossil fuels for the oil- and gas-intensive Gulf region, but it was far from a runaway success: Only two companies bid for the leases on offer.

The sale isn’t the only sign of trouble for the U.S. offshore wind industry—and some major players are flagging problems to come. Following a summer of canceled projects from various companies, Danish offshore wind giant Orsted said in an interview with Bloomberg on Tuesday that it needed more help from the U.S. government if it was going to move forward with its U.S. projects. “We are still upholding a real option to walk away,” CEO Mads Nipper told the outlet.

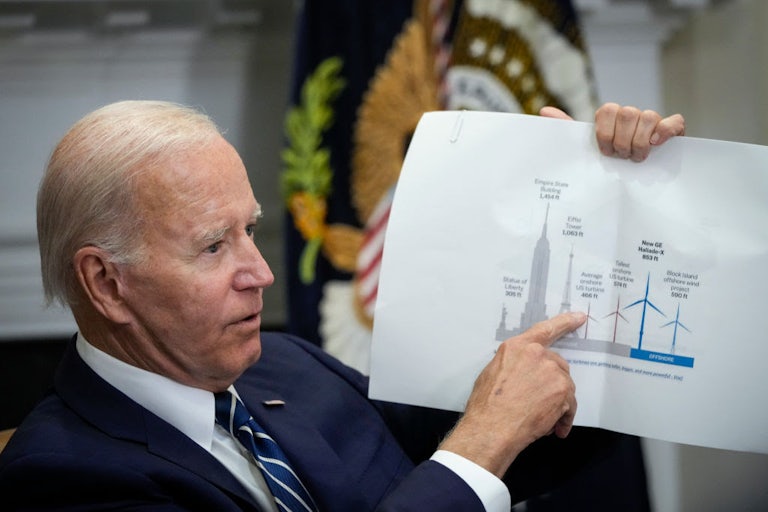

The Biden administration has made kick-starting the U.S. offshore wind industry a core part of its climate agenda, while also hoping to make it a cornerstone of Biden’s plans to invest in manufacturing jobs. It set an ambitious goal of installing enough offshore wind energy to power 10 million homes by the end of the decade. But despite record investments and government incentives, some serious headwinds (pardon the pun) are facing the industry. From the hard financial realities of building capital-intensive infrastructure projects to serious fossil fuel–funded political opposition, there’s a rocky road ahead for offshore wind over the coming years—no matter how much support or incentives the Biden administration throws at it.

When climate people talk about the renewable energy transition, they tend to wax poetic about the continually plummeting costs of wind and solar. That holds true for wind on land but is not the case for its offshore component. Siting and construction for offshore wind turbines is, unsurprisingly, much more expensive than for onshore wind; some estimates place the price tag for a kilowatt-hour of energy produced by offshore wind almost five times as high as that same kilowatt-hour produced onshore. There’s a lot of labor and time involved in installing skyscraper-size turbines miles off the coast. While onshore wind has had a steady foothold in the United States for decades, there are only two offshore wind farms currently operating in the U.S., off the coast of Virginia and Rhode Island. Many of the proposed projects are having to start from scratch in figuring out manufacturing and labor.

When you add the high price of materials like steel, things get even trickier. Because they don’t face many of the siting regulations that affect onshore turbines, individual offshore turbines can be designed much larger than their onshore counterparts in order to capture more power. These turbines are only projected to grow bigger over the coming decades. That’s great news for the grid but means higher installation costs up front.

Many of these problems are not unique to the offshore wind industry; with high worldwide prices for raw materials and labor, plus sky-high interest rates in the U.S., it’s not exactly a great time for huge infrastructure projects in general. As Bloomberg’s Liam Denning wrote last month, offshore wind has a lot more in common with the nuclear industry than it does with its onshore counterpart in terms of big, lengthy projects with a lot of upfront costs—and is similarly going to have to rely on the government to get a lot of its farms across the finish line.

For capital- and time-intensive industries like offshore wind and nuclear, the political support of a presidential administration can make or break projects. In the U.S., the Trump administration’s antagonistic attitude toward renewable energy created several roadblocks and additional lag times for offshore wind, including, ironically, a last-minute environmental review for already-delayed projects in the Atlantic Ocean. All the Biden administration’s encouragement and tax incentives can’t make up for lost time. (Some developers are flagging that certain requirements in the Inflation Reduction Act—including, notably, that turbines be made in the U.S. and sited in specific communities—are making it more difficult to access those incentives.)

And unlike nuclear, which has seen a dramatic surge in support from the center and right wing in recent years, offshore wind is currently the target of a massive misinformation campaign. Since Biden took office and projects around the country have begun to move forward, right-wing groups—many funded by fossil fuel interests—have mobilized grassroots opposition (or created it wholesale) along the Atlantic coast, professing concern for offshore wind’s impact on wildlife. In places like New Jersey, offshore wind developers are facing lawsuits from these astroturf groups that are tangling up the process.

Even if offshore wind companies manage to weather the industry’s financial troubles and handle these lawsuits, this political opposition isn’t something to be ignored. The GOP is learning to more creatively campaign against climate action and figuring out different ways to boost fossil fuels when it’s not in power. As we saw with the Trump administration, much of the American clean energy project is a long game, requiring years of encouragement and incentives; the most enthusiastic, pro–climate action administration in the world can’t play catch-up if we go back to square one every election cycle.

Good News, Bad News

![]()

A Memphis-area plant that uses carcinogens to sterilize medical equipment will shut down following years of activism from community members living around it.

![]()

An entire town in Louisiana was forced to evacuate last week as part of Louisiana’s “unprecedented” summer of wildfires—August alone saw 441 fires.

Stat of the Week

25%

That’s how much climate change has increased the risk of wildfires in California, a new study shows.

Elsewhere in the Ecosystem

Climate change came for Burning Man this year—but last year, its organizers helped stop a geothermal energy project in the desert where the festival is held, Grist reports:

The Burning Man Project, the lead plaintiff in the lawsuit, also worked with residents of the tiny town of Gerlach, the hamlet closest to the geothermal development, to appeal the [Bureau of Land Management]’s decision. The wells, the organization said, would “threaten the viability” of Burning Man’s various projects in Nevada by potentially jeopardizing local hot springs in the area and disrupting the desert ecosystem. The plaintiffs argued that BLM had approved the project without adequate environmental review and hadn’t sufficiently consulted local communities, including the Summit Lake Paiute Tribe, in its permitting process.

“People travel to Gerlach to experience the solitude of the vast open spaces and undeveloped vistas present in the Black Rock Desert,” the lawsuit said, “as well as to attend numerous events and to pursue a variety of recreation experiences in the undeveloped desert.” …

The claim that the region remains relatively undisturbed, given the 70,000-person party that rolls in every year, rang particularly hollow.

“Some of the hype around Gerlach has been disturbing from a scientific point of view,” James Faulds, Nevada’s State Geologist, told Grist. “The Gerlach area has already been disturbed by man.”

Read Zoya Teirstein’s full piece at Grist.

This article first appeared in Life in a Warming World, a weekly TNR newsletter authored by contributing deputy editor Molly Taft. Sign up here.

.png)