I. A Warning to the Washington Expert

Happily, we are entering upon a time when the end of the war in Europe is in sight. Each day’s newspaper makes this more and more clear, but its real imminence was only brought home to me by a recent trip to Washington, the first in a year. Everywhere I went I could smell cuts in war production; in the corridors of the Social Security Building, where WPB dollar-a-year men are still a dime a dozen; in the sweltering “temporaries,” where OPA dignitaries hide; and the scent had even penetrated the marbled tabernacle of the Federal Reserve Board.

Already estimates are being prepared for important production slashes in the last quarter of 1944, with even more drastic ones to follow. Necessarily, most of the forecasts are confidential in character, but even without access to inside information, one can plausibly guess that cuts in munitions production of from 25 to 50 percent are in the offing, once the victory in Europe is clearly assured. Nor need such assurance wait upon the actual complete defeat of the enemy. With the momentum of the Red Army in the East matched by our own forces in France, even the armed services will be forced to admit the inexpediency of starting and continuing production which cannot conceivably be available in time for effective use. Because of the extraordinary weakness of the Luftwaffe, in all but a few strategic lines production and stockpiles are ahead of requirements, Advisedly or inadvisedly, the army has deliberately chosen to concentrate public attention upon the shortages in heavy trucks, air-borne radar and heavy bombers for fear that production will slacken as a result of overconfidence. The recent resignation of Bassie and Kaplan from the WPB in protest against army censorship and emphasis simply brings out into the open a struggle that has been going on for some time between the conflicting points of view of Donald Nelson and General Brehon B. Somervell on the necessity for early steps toward reconversion. If the war goes as well as official circles now expect it to, in a very short time the Somervell forces will have to yield, if only because the stuff is piling up too rapidly. But in the meanwhile precious time will have been lost.

The situation is complicated by entrepreneurial jockeying for competitive position in postwar markets. Even more than workers, management is becoming edgy as the end of the war draws near. In some important industries, firms are not striving with the same old aggressiveness for new war contracts in the fear that they will be left behind in the reconversion race. “Business as usual” had serious consequences in the defense period; it may be no less harmful in the months ahead.

Cuts seem most likely in the fields of ground equipment, aircraft production and the merchant marine. By emphasizing the maritime character of the Pacific war, the navy may succeed in staving off reductions in ship construction. Weighing all factors, we shall probably not go far wrong if we estimate about a 40-percent slash.

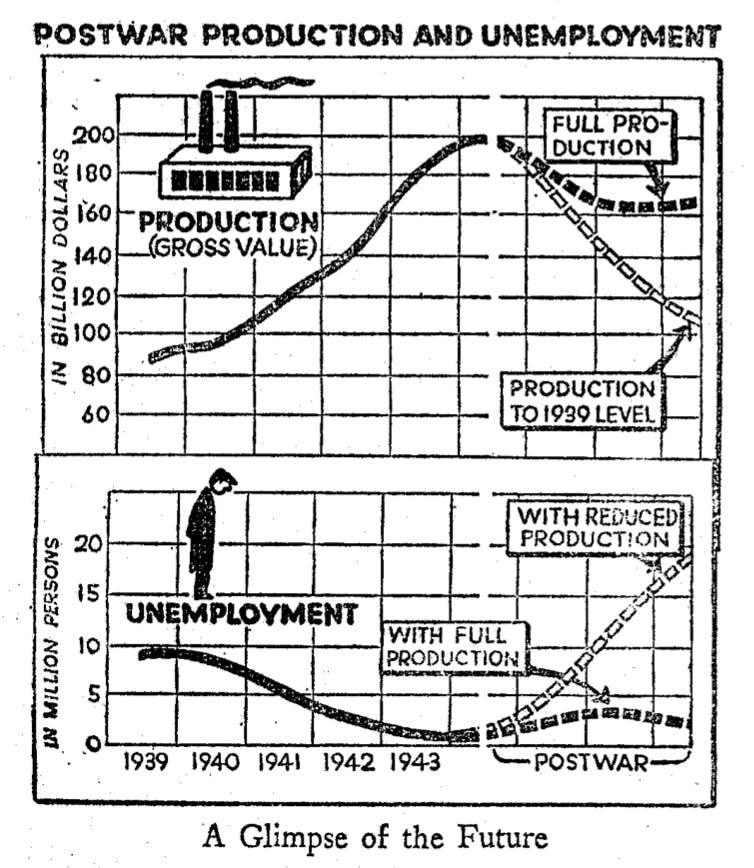

A 40-percent cut in war production should not be interpreted as a reduction of 40 percent in the current $90 billion annual rate of expenditure on war. Only part of this sum is spent on munitions and related ordnance; the rest, which involves pay for soldiers, subsistence and maintenance, etc., is: about one-third of the total. Nevertheless, a cut of 40 percent in munitions expenditure would involve a drop in production of about $25 billion per year, reckoned as an annual rate. In real terms this is about equivalent to one-fifth the peak prewar level of output; or to more than one-tenth of present wartime levels. Perhaps the significance of this sum can be appreciated if we recall that it is only slightly less than the drop of consumption from the peak of the boom of the twenties to the bottom of the trough of the Great Depression.

Such a cut will not imply a full 10-percent reduction in the present labor force of some 63 millions, but it will mean a loss in the high-productivity jobs which we can least afford to forfeit. If we add as well what is a fairly conservative estimate, that some two million soldiers will be demobilized during the one-front Japanese war, we may begin to anticipate unemployment or underemployment of around five million men. And that is not yet the end of the story. Every time a man becomes employed in depression times, he brings into employment with him, as a result of his spending of income, one or two other men. This is the so-called “multiplier” doctrine, that bit of glorified common sense which economists of all schools now largely recognize.

But the knife can cut in both ways. When employment is curtailed, the multiplier goes into reverse, and each man thrown out of employment takes others with him. There are reasons to expect that the multiplier will not in the months ahead attain its usual magnitude because autonomous private consumption and investment will expand, but nevertheless these secondary effects are of too great importance to. be neglected. Finally, and these tertiary effects can be most disastrous of all, if ever a serious decline gets well under way, panic on the part of consumers and producers may become widespread, in which case the downward spiral of employment and income could become precipitous. Again, there are reasons to doubt that the last eventuality will materialize in its full virulence. Still, it is a contingency which policy makers will neglect only at their peril, or rather only at the nation’s peril.

Once acquainted with the above facts, any reasonably well informed layman, even though it is not his concern to anticipate future economic developments, will instantly recognize that a serious storm is on the horizon. If we can expect this from the amateur, what can we presume to be the view of the professional Washington economist, the full-time expert with all of the statistical resources of the government at his disposal, the experienced executive whose official responsibility it is to foresee and forestall by appropriate policy measures all threats to our prosperity? Surely he has an elaborate set of plans, ready to go into effect the moment the emergency arises. Or at least he must be working frantically to make good the deficiency before the zero hour is upon us. Unfortunately, this is not the case.

The experts have not perceived the magnitude of the storm ahead. The executive branch of the government does not have even a normal year’s amount of public works in a processed form ready to go into quick operation. The Washington economist is not now devising sufficient measures to relieve or reduce unemployment. His digestion is good, and at night he experiences no nightmares.

The above remarks require qualification. It is not true that the Washington economist is completely without worry. If you press him, he will admit that he is concerned about the winter of 1951 when the backlog of deferred demand for automobiles and helicopters will have spent itself. Or if he is of a lachrymose disposition and the weather is gray, he may push up the date to the spring of 1948. But because he is fairly confident of the intermediate period following reconversion, he quite naturally is not alarmed about the demobilization period, but only concerned to lessen by policy action the incidence of the purely technical delays in reconversion.

This is the strange phenomenon of our times. The academic economist who only yesterday was preaching the imminence of secular stagnation and the need for governmental offsets to saving, who scoffed at the naive notion that a little bit of spending would cut the vicious spiral of depression and “permit” the economic system to carry forward in perpetuity on its own steam—this same individual today is worrying lest purchasing power privately created in the postwar period be greater than even peaks of wartime production can fill. Mind you, it is not of dollar-a-year men I speak; in some instances these have had a healthy restraining influence upon the economists’ soaring imaginations. If one goes out into the country, it becomes only too obvious that the business man in general is skeptical concerning the possibility of expanding his own plant’s production to the point which he is told is necessary if we are to avoid widespread unemployment. No, the men I have in mind are in many cases New Dealers, known in the past for their immunity to the speculative fevers of the moment.

I do not wish to be misunderstood. It has been said that the last war was the chemist’s war and that this one is the physicist’s. It might equally be said that this. is an economist’s war. Especially in the business-as-usual period, but equally since, the Washington economist, whether recruited from the permanent civil service or from academic life, has done an excellent job, either in comparison with reasonable expectations or in comparison with business executives who have been called to the government service. At a time when the term bureaucracy is anathema, it is well to emphasize that no administration in history has commanded the services of men.of equal zeal, honesty or competence.

Perhaps I am creating a misleading impression of the power of the economist when it comes to policy matters. Largely, he is the hewer-of wood who provides the factual and analytic background for decisions arrived at by higher officials, His ideas are not without influence, but they become of influence not so much on their abstract merits as because they happen to fall in with the “realities” of the immediate situation, But despite this inevitable selective process, the significance of ideas should not be discounted. The current gospel of the Committee for Economic Development derives in obvious and obscure ways from the analysis of the Washington economist. The present mad rush to forgive taxes for the purpose of encouraging “venture capital” stems in part from the academic discussions of the past decade. All of these are rationalizations, yes; but they have a force in their own right, too.

Nevertheless, or perhaps because of his successful wartime preoccupation with scarcity of supplies, shortages of manpower and resources, excesses of purchasing power and inflationary gaps, the Washington economist has for the moment Jost his perspective concerning the immediate postwar problem, Because he responds quickly, I have every confidence that he will snap out of his dream when the true facts become apparent.

The Washington economist lives in a world frequented by his own kind. I know, for I have lived in that happy world. When he hears that someone else has arrived at the same optimistic estimate as his own, he takes this to be independent corroboration of the truth of his view instead of realizing that it is simply the reflection of his own last week’s expression of opinion. This process of mutual infection and amplification of opinion is cumulative and self-aggravating, so no wonder his conviction grows without bound.

Recently a representative of an investment-counseling house made a rather careful estimate of the effects of the end of the European war. Among other things, he concluded that income payments might fall from $150 billions to $110 billions if something were not done about it. He showed this to his business friends and they were universal in thinking that his estimates were far too optimistic. He proceeded to Washington to get the benefit of the government experts’ criticisms. Everywhere he went, with one minor exception, he received the horse-laugh for being so pessimistic, At one place he was told, “Why, you talk like Leon Henderson, who thinks there will be eight million unemployed. Actually, when you allow for resource evaporation [a polite name for disguised unemployment and lowered productivity], even transitional unemployment will be nominal.” I may add that Henderson is not regarded as “an economist’s economist.” Perhaps at the moment that is his strength and salvation.

II. The Coming Economic Crisis

The remarkable complacency of the Washington expert in the face of impending serious unemployment was discussed in the previous article. Before enlarging on its momentous consequences, we may inquire into the origins of this optimism, shared by neither labor, agriculture nor industry.

Three years ago when I first went down to Washington, everyone was extremely pessimistic. The extreme reluctance of the business community to expand (at the government’s expense) plants badly needed for the war indicated pretty clearly who were the real believers in secular stagnation. Pessimism was clearly overdone, and gradually the economist began to marshal the following rays of hope: (1) Even a superficial glance—and they were mostly superficial—at our experience after the last war shows that disaster did not follow upon utterly planless demobilization and production slashes. (2) In this war, as producers’ and consumers’ durable goods became unavailable, the realization grew that there might come out of the conflict a backlog of deferred demand. (3) Later, increased emphasis was placed upon the financial fact that high war incomes without high levels of civilian goods inevitably meant the piling up of extraordinarily high levels of individual and corporate savings. Whether in the form of cash or bonds, these could provide stimulus after the war. One government statistician, who shall be nameless, actually predicted 40 years—count them! Of uninterrupted prosperity on the basis of this factor alone, and he concluded, logically enough, that post-war planning was no necessary. (4) The Great Depression pretty much gave the lie to the view that a laissez-faire economy necessarily produces an even keel of business activity, but the notion still lingered deep in the bosom of many economists.

After months and years of wartime prosperity, memories of unemployment faded and the original notion reasserted itself, but with one significant difference. The cry began, “Business enterprise can create its own prosperity,” with the appended proviso, “so long as government restores a favorable environment to venture capital, etc., etc.” (5) And finally as a last resort, if any lingering doubts remained concerning the inevitability of postwar prosperity, the economist could always draw a blank check upon the wonders of technology which the war would spew forth—television, flivver planes, synthetics, air-conditioning, plastic autos, and so on.

There is a grain of truth in each of these points, and therein lies their danger. For the immediate period ahead, they are less relevant than for the intermediate long run after the shock of demobilization and reconversion has been successfully met. But in any case, no one of them, or all together any combination quantitatively, can compare with the most striking factor in the present situation, concerning which we have become so jaded as to forget its existence.

Every month, every day, every hour the federal government is pumping millions and billions of dollars into the bloodstream of the American economy. It is as if we were building a TVA every Tuesday. Did I say every Tuesday? Two TVA’s every Tuesday would be nearer the truth. We have reached the present high levels of output and employment only by means of $100 billion of government expenditures, of which $50 billion represent deficits. In the usual sense of the word, the present prosperity is “artificial,” although no criticism is thereby implied. Any simple statistical calculation will show that the automobile, aircraft, ship-building and electronics industry combined, comprising the fields with rosiest postwar prospects, cannot possibly maintain their present level of employment, or one-half, or one-third of it.

I myself am somewhat apprehensive over the period after reconversion and demobilization. But even if I am wrong or especially if I am wrong, it is demonstrable that the immediate demobilization period presents a grave challenge to our economy. How well we meet it will not simply determine living standards and unemployment in the next fifteen months. The tone of the whole postwar decade will be crucially conditioned by our degree of success in providing continuity of income and employment in the transition period from war to peace.

To men on the fighting fronts, civilian life, must now seem remote. And yet, soon after peace comes, recollections of battle will mercifully fade and in memory the war years will appear as a point of no duration but of infinite intensity. To the civilian population the war period, is scarcely more real. Only gradually are we becoming accustomed to a full-employment economy, where effort and skill are needed and sought after. Even more precious than the augmented family weekly take home, is the enhanced sensation of personal security which a high level of effective demand, has created. In. the last war, many observers were shocked to hear the frank assertion, “Say what you will, this war has made many a happy home.” It is a sad commentary upon our peacetime management that the same feelings should be entertained today by more people than would care to admit it.

But underneath, in the deep recesses of the subconscious, there is uneasiness. Men of all occupations feel that it is the war which has brought transient prosperity. After the war, what? Everywhere we have quit jobs with permanent tenure, have married, have had children. All of us feel that we are riding a tiger. We push worries about the future out of our minds because there is no use in worrying. In a dim way we feel that if things get bad enough, the government will have to do something about them, and this is but cold comfort. Despite a superficial veneer of optimism, a great fear stalks the land.

Since no one quite believes in the great increase in national product during the war, it will be only too easy after the war to become adjusted to a level of income far lower than is within our power to produce. If production is permitted to slump, if economies of large-scale operation are sacrificed, if valuable members are driven out of the labor market against their will, if hours are cut beyond the true preference of workers for leisure over income, the dramatic lesson of the war will be wasted.

I predict that the campaign to debunk wartime increases in production, which is just beginning, will swell into a mighty chorus. We shall be told that war prosperity was an illusion; that we did not produce what we did produce; that even if we did, such output is incommensurable with civilian goods and proves nothing about peacetime real incomes, etc., etc. There is a small bit of truth in such arguments. Some water is to be found in war-production figures. Our labor force is swollen beyond maintainable standards. But make no mistake about it. Upon any reasonable, conservative reckoning, it is absolutely certain that prior to the war we were underproducing by an amount far greater than anyone realized. This was the tragedy of the thirties, scarcely less terrible than the mass unemployment of the decade: the American economy was frittering away in unemployment, underemployment and disguised unemployment a vast and ever increasing amount of real income.

It would be even more tragic if the truth revealed by the war were to be lost in its aftermath. For we can attain our true potential only by striving after it. There is a growing group, who, are appalled by this prospect, who are beginning to fear full employment itself. Our greatest immediate postwar need, therefore, is to establish, for the record one or two undeniably high peacetime years of real income.

If we fail, blood will not run in the streets. We shall not necessarily have fascism or communism. Probably veterans will not sell apples on corners. Corporation profits will not disappear. Hourly wage rates will not be driven down to a subsistence level.

Our system only too easily adapts itself to unemployment. Technology is so improved that unless we mismanage our economy completely, we shall still have more real income than before the war, and more real consumption than during the war. But to live up to our technological potential, to provide full opportunities for employment, to create a measure of personal security, we must go more than 50 percent beyond highest prewar levels. We must see that any relaxation from peak war outputs is simply that, and not a vicious, cumulative, spiral of unemployment. If we do not succeed in this, it will be bad economics. To let the war years remain in popular memory as a kind of utopia would be equally bad politics and morality.

I shall not attempt here to answer in detail the inevitable question, “What to do about this?” Fear has a harmful effect upon action. Let the people and policy-makers become cognizant of the grave situation ahead. Let them worry about it sufficiently to become motivated to act. Let them proceed in a common-sense way from their own diagnosis of the origins of wartime prosperity. Let them disregard the shibboleths, inconsistencies and confusions of so-called orthodox finance. Let them do these things, and they will not need the advice of high-powered theory or statistics to determine in which direction correct policy lies.

Economically, the war did not begin with Pearl Harbor. Nor will it end with the defeat of Japan. Our economic system is living on a rich diet of government spending. It will be found cheaper in the long run, and infinitely preferable in human terms, to wean it gradually. In no six-month period should the cuts in government expenditure run ahead of civilian expansion by more than $10 billion.

Today one often hears that private industry should be given a chance to carry the ball; if it fails, the government should step in. This is a dangerous gamble, as unfair to private enterprise as to the nation at large. A better analogy from the world of sport would be passing the baton in a relay race. The receiver must acquire almost the same momentum as the passer before the transfer is made. Otherwise, the pace is lost and the stick may be fumbled. Until civilian production is in a position to expand, the government must be moderate in its slashes.

This means we must embark upon a substantial program of income maintenance via welfare payments, social security, etc. We must exercise the greatest ingenuity in overcoming the technical delays to reconversion along with the effective prosecution of the war. We must be planning more on a state and national scale for a vast expansion of useful public construction, for its own sake, and for maintenance of income and employment. We must correctly appraise the true social costs to ourselves of loans, gifts and relief activities abroad, and decide what we can afford. We must repeal regressive taxes which curtail consumption.

Most important of all is the need to recognize the “spotty” character of the period ahead. We shall have incipient inflationary gaps alongside deflationary gaps, labor-market dislocations and unemployment. Every vitally important governmental policy will somewhere add to inflationary pressure, just as will every expansion of civilian investment and consumption. By unwinding direct controls gradually, we can hope to avoid the worst of both worlds of inflation and deflation, but not otherwise.

None of these is a difficult matter, but each one requires more than a policy of muddling through. For better or worse, the government under any party will have to undertake extensive action in the years ahead. Simply to pile up more obsolete munitions as a boondoggling device to avoid unemployment would indeed be counsel of despair—bad politics, bad morals, bad social accounting. But to let a major slump develop through inaction—that would be a counsel of disaster.