The Supreme Court on Thursday overwhelmingly ruled that the Consumer Financial Protection Bureau’s funding structure is constitutional, rejecting what would have been an existential threat to the agency. The decision is yet another rebuke to the Fifth Circuit Court of Appeals, the right-wing court that has embraced a variety of outlandish legal theories in recent years, but also a major defeat for the conservative legal establishment, which has worked tirelessly to kneecap the CFPB.

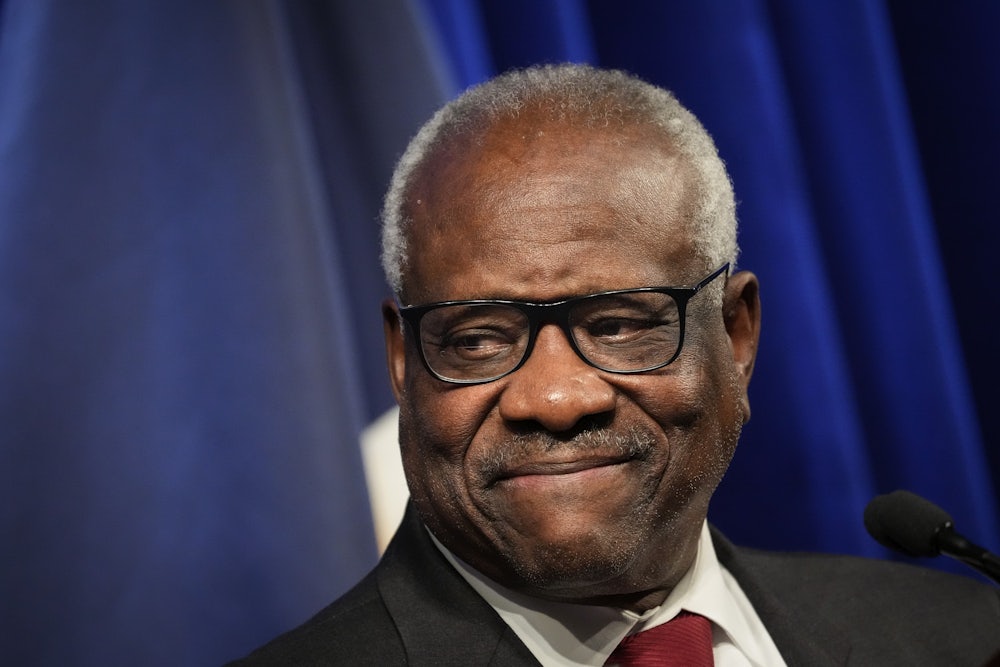

The ideological breadth of the 7–2 majority opinion, which was written by none other than Justice Clarence Thomas, only underscores how increasingly out of step those twin forces are with the law and the country.

As if to emphasize that point, two of the court’s conservative members joined a concurring opinion by Justice Elena Kagan where she argued that “continuing tradition” supported the court’s decision in favor of the agency. “The way our government has actually worked, over our entire experience, thus provides another reason to uphold Congress’s decision about how to fund the CFPB,” Kagan explained, joined by Justices Sonia Sotomayor, Brett Kavanaugh, and Amy Coney Barrett. Faced with that diverse lineup, lower courts may now be more hesitant to embrace similar challenges to the agency in the future.

The CFPB’s origins—and this case’s ultimate question—trace back to Elizabeth Warren, a Harvard University law professor at the time and a U.S. senator from Massachusetts today. She proposed consolidating the federal government’s various enforcement powers over consumer financial institutions into a single agency in 2007. A few years later, after the financial crash of 2008 and the start of the Great Recession, Congress created the agency as part of the Dodd-Frank financial reforms in 2010.

As with other financial regulators, lawmakers gave the CFPB a degree of independence from the political branches to ensure its integrity. One of those safeguards is its funding structure. The agency does not go through the annual appropriations process like other federal agencies. Instead, its director draws upon the earnings of the Federal Reserve System up to an inflation-adjusted cap set by Congress. (Its budget for the fiscal year 2022 came to about $734 million.) The structure is perpetual and self-executing; Congress could theoretically never appropriate a dollar of general Treasury funds to the agency again.

Today, the CFPB promulgates rules for banks, insurers, mortgage brokers, payday lenders, credit card companies, student loan servicers, and so on. This made it a natural enemy of the modern American gentry, particularly the most financialized among them. The CFPB’s most frequent targets for regulatory scrutiny—the car-dealership owners, the investment-firm branch managers, the local bank presidents—also happen to be the backbone of the Republican Party’s funding apparatus.

It is therefore no surprise that Republicans have sought to hamstring, undermine, and destroy the agency since its creation. During the Trump administration, the conservative legal establishment successfully fought in Selia Law v. CFPB to remove the for-cause protections for the agency’s director, allowing presidents to fire them at will. Trump’s appointed CFPB directors also came under fire for their friendliness toward the financial institutions they were regulating. As a D.C. Circuit judge, Kavanaugh rose to prominence in right-wing legal circles for an opinion he wrote that described the agency’s pre–Selia Law structure as a “threat to individual liberty.”

Thursday’s case, Consumer Financial Protection Bureau v. Community Financial Services Association, centered on an attack from payday-lending companies. In 2017, the CFPB promulgated new rules for the industry that restricted how frequently payday lenders could make automated withdrawal requests from their customers’ bank accounts. CFPB officials said during the rulemaking process that excessive requests were “unfair” and “abusive” because they could trigger overdraft fees for the customers and even lead to the closure of their bank accounts.

The Community Financial Services Association, a trade group for the industry, filed a lawsuit in 2020 in a federal district court in Texas to challenge the rules—and the agency itself. It argued that the CFPB’s funding structure itself violated the Constitution’s appropriations clause, which says how Congress can spend public funds. The clause’s language is fairly straightforward: It says that “no money shall be drawn from the Treasury, but in consequence of appropriations made by law.”

The CFPB’s funding system, argued the payday lenders, violated the Constitution because it gave too much control over funding to an executive branch agency. “This case is about checks and balances,” Noel Francisco, who represented the lenders, told the justices at oral arguments in October. “One of Congress’s most important checks on executive power is its power of the purse. That’s why Alexander Hamilton said that the unification of sword and purse was the very definition of tyranny. This case reflects precisely that feared unification.”

These arguments worked wonders for a favorable audience, and the Fifth Circuit Court of Appeals leaped at the opportunity to abolish the agency. Writing for a three-judge panel, Judge Cory Wilson suggested that the CFPB was an “elective despotism,” by way of quoting the Federalist Papers. He noted its “capacious portfolio of authority” and quoted a Supreme Court ruling that described it in passing as “an innovation with no foothold in history or tradition” and “a mini-legislature, prosecutor, and court” that levies “knee-buckling penalties against private citizens.”

“An expansive executive agency insulated (no, double-insulated) from Congress’s purse strings, expressly exempt from budgetary review, and headed by a single Director removable at the President’s pleasure is the epitome of the unification of the purse and the sword in the executive—an abomination the Framers warned ‘would destroy that division of powers on which political liberty is founded,’” Wilson claimed. All of this hyperventilating gives the misleading impression that CFPB officials are going to break down your door and put a jackboot to your throat.

Solicitor General Elizabeth Prelogar, who represented the agency, told the justices that two centuries of practices confirmed the appropriations clause’s breadth. She noted that Congress has often funded federal agencies other than through annual appropriations, especially in the early republic. And she emphasized that the Constitution’s other limits on spending show that the Framers knew how to include checks on Congress’s authority if they had wished to do so.

“The text of the Constitution shows that when the Framers wanted to limit Congress’s appropriations authority, they did so expressly,” she wrote. “And while the Framers restricted appropriations for the Army to two years, they applied no similar limits on appropriations for any other agency.” She also pointed to unusual founding-era funding structures for the Customs Service and the Post Office to underscore her point.

That originalist argument persuaded Thomas and most of his colleagues. He reviewed the English origins of the congressional spending power as well as early founding-era practices by American legislatures, noting that it took a wide variety of forms. Based on that history, he concluded that Congress “need only identify a source of public funds and authorize the expenditure of those funds for designated purposes to satisfy the Appropriations Clause.”

Justice Samuel Alito strenuously disagreed with that broad interpretation. In a dissent joined by Justice Neil Gorsuch, he adopted Wilson’s view of the agency as fundamentally flawed and dangerous. “The Framers would be shocked, even horrified, by this scheme,” he wrote, referring to the CFPB’s funding structure. Alito lamented that the court’s ruling would “[turn] the Appropriations Clause into a minor vestige,” claimed the clause “has a rich history extending back centuries before the founding of our country,” and lamented the dangers that the ruling would pose to liberty and congressional oversight.

The dissent is vintage Alito. He started by reframing the question presented to the justices in a way that presupposes his preferred result. “Today’s case turns on a simple question: Is the CFPB financially accountable to Congress in the way the Appropriations Clause demands?” he wrote. “History tells us it is not.” That formulation assumed that the clause made specific “demands” that the agency be “financially accountable” to Congress beyond what Thomas described.

To buttress his approach, Alito reads all sorts of things into the clause in a most un-originalist manner. He dismisses Thomas’s attempts to discern the Framers’ understanding of the term “appropriation” by describing it as “consulting a few old dictionaries,” something that originalist justices do all of the time. “This analysis overlooks the fact that the term ‘appropriations,’ as used in the Constitution, is a term of art whose meaning has been fleshed out by centuries of history,” he wrote. So much for the original public meaning.

Like Thomas, Alito devoted a significant portion of the opinion to the clause’s historical context. But there is a strange detachment between Alito’s reading of history and the conclusions he drew from it. He recounted the ways in which Parliament supervised royal expenditures without explaining why it was relevant to the actual question at hand. “Although that history is a helpful starting point, it at most explains why appropriations must be ‘made by Law’—not what it means for the legislature to make an ‘Appropriation,’” Thomas pointedly observed.

Alito’s arguments on founding-era appropriations in the Thirteen Colonies and the early republic are no more persuasive. He argued that Congress’s historical practices suggested that it meant for annual appropriations to be the constitutional norm. A wide range of evidence that suggests otherwise was dismissed with the wave of a hand. “To be sure, not all early funding laws followed the dominant model of specified short-term appropriations,” Alito noted, perhaps not realizing that he had given up the ghost. Thomas, for his part, politely described his colleague’s argument as “not convincing.”

Legal challenges to the CFPB for its regulations and enforcement decisions are inevitable, of course. But the demise of the appropriations clause challenge should mark the end of the conservative legal campaign to have the agency declared unconstitutional for one reason or another. Whether that will deter the Fifth Circuit from embracing nonsensical legal theories from right-wing litigants is unclear. If not, the Supreme Court may be less subtle about rejecting them in the future.