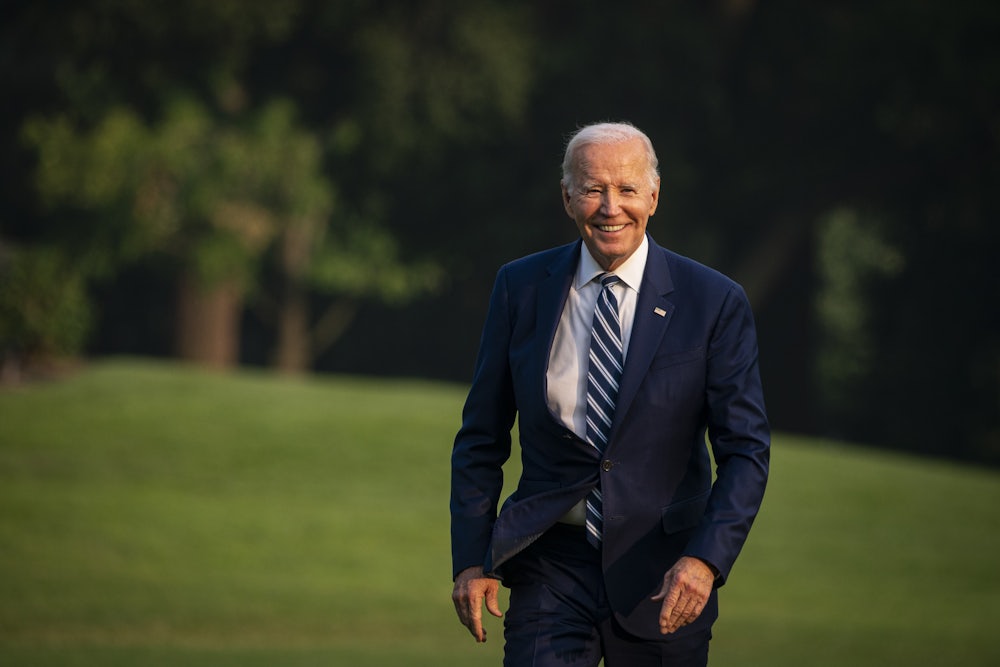

Joe Biden traveled the country this week on an “Investing in America” tour intended to persuade the public that the economy has improved under his presidency. Early reviews were not favorable. “Americans are worse off under Biden,” said Republican National Committee Chair Ronna McDaniel.

Savings, real wages, and economic confidence are all down while prices continue to skyrocket, and hardworking Americans pay the price for failed “Bidenomics.” Voters don’t want Biden to “finish the job,” and will make that clear in 2024.

McDaniel quite obviously has a partisan ax to grind, but the public readily agreed. According to a poll released Wednesday by the Associated Press-NORC Center for Public Affairs Research, only 34 percent approved of Biden’s handling of the economy. Fully 40 percent of Democrats thought Biden was mishandling the economy.

I don’t dispute that a lot of people are struggling. The economy has been short-changing the middle class for four decades; I wrote a book about that. But the public is wrong to believe that Biden is making things worse. He’s making them better. Much better. Did you hear that the Biden administration last week helped persuade five rail companies to grant workers sick days after Biden caught hell (from, among others, me) for leaving guaranteed sick days out of the congressionally imposed contract he signed into law in December? Me neither! I learned it from reading a piece that New Republic editor Michael Tomasky posted earlier this week. Uh, sorry to miss that, boss. But nearly every business reporter in America missed it too. For various reasons, the business press has been reluctant to share the good news about Biden’s economic policies.

Before we get to that, let’s take a moment to review McDaniel’s statement. It was dishonest in every particular.

Savings are down. Nonsense. Personal savings have mostly risen this year; they fell a bit in April, but bounced back in May to 4.6 percent and remain above their level in January.

Real wages are down. Yes, real weekly wages (that is, wages corrected for inflation) are down, but that’s not because, as McDaniel suggests, inflation is rising—over the past year inflation has halved—but because nominal wage growth is slowing, which is what every economist in America is rooting for so that the Fed will ease up on interest rate hikes. And not all real wages are down. In May, the last month for which data are available, real average hourly wages ticked up.

Economic confidence is down. Bullshit. Gallup’s index of economic confidence “improved significantly” in June, the pollster reported Wednesday, reaching its highest level since January 2022. If “economic confidence” sounds unfamiliar, that’s because it’s a metric that’s largely fallen into disuse; Gallup only barely keeps track of it anymore. What McDaniel probably meant to cite was the much-better-known consumer confidence index. But she couldn’t cite that, because the day before she released her statement the Conference Board reported that consumer confidence surged upward in May to its highest level since January 2022. That news is actually too good, because the Fed wants consumer confidence to cool before it eases up on interest rate hikes.

Prices continue to skyrocket. Inflation was up 4 percent last month, which I hardly call “skyrocketing.” Inflation ran at 4 percent or higher nearly every month of President Ronald Reagan’s second term, the culmination of what Wall Street Journal editorialist Robert Bartley rapturously dubbed “the seven fat years,” when it was “morning in America.” Indeed, the Johns Hopkins economist Laurence M. Ball argued in a 2014 paper that inflation should be 4 percent all the time. More specifically, Ball argued that central banks like the Fed should target 4 percent inflation rather than the usual 2 percent to avoid situations where the economy requires stimulus from the central bank but interest rates can’t fall any lower. Economists call this the “zero bound.” The higher the target inflation rate, the higher routine interest rates will be, leaving central bankers more latitude during downturns to drop interest rates before they hit the zero bound. Even inflation hawk Lawrence Summers of Harvard has suggested he could live with a target inflation rate of 3 percent.

But wasn’t inflation Biden’s fault? Didn’t he cause it by spending stimulus money like a drunken sailor? Olivier Blanchard, Robert M. Solow professor emeritus at MIT and now a senior fellow at the Peterson Institute for International Economics, predicted that the 2021 Biden stimulus would cause inflation by overheating the labor market. But in a paper Blanchard co-authored in May with Ben Bernanke, former Federal Reserve chairman, Blanchard conceded that he’d been wrong. The stimulus had not overheated the labor market, Bernanke and Blanchard concluded. Rather, inflation had arisen from supply chain foul-ups caused by the Covid epidemic, an act of God rendered worse by comic-opera mismanagement under President Donald Trump. (Among other things, the Trump administration altered multiple Centers for Disease Control and Prevention guidances on Covid to downplay the crisis, according to a staff report from the House Select Subcommittee on the Coronavirus Crisis issued three months before the GOP regained control of the House.)

The two most important bellwethers for the health of the U.S. economy, just about everyone would agree, are the unemployment rate and gross domestic product. McDaniel mentioned neither. That’s because unemployment, as Biden noted correctly in a speech on Bidenomics delivered this week in Chicago, has been below 4 percent for the longest stretch in half a century. (In May it was 3.7 percent.) Indeed, many economists have lately argued that unemployment is too low, not only because it’s inflationary but also because at a certain point labor market shortages create inefficiencies that hurt the entire economy. According to a 2022 paper by the economists Pascal Michaillat of Brown and Emmanuel Saez of Berkeley, the U.S. labor market has exceeded “full employment” since May 2021. But don’t hold your breath for McDaniel to complain that under Biden too many Americans are in possession of a job.

Gross domestic product, meanwhile, expanded during the first quarter of 2023 by 2 percent. That’s down from 2.6 percent during the third quarter of 2022 but still more robust than the Fed would like to see. Again, don’t expect McDaniel to complain that under Biden the economy is expanding too rapidly.

Why does the public swallow McDaniel’s drivel? Partly out of lazy habit. As the journalist Christopher Matthews pointed out decades ago, the public sees Democrats as the Mommy Party and Republicans as the Daddy Party, with Mommy and Daddy adhering to stereotypes rooted in prehistory. Mommy gathers nuts and berries and kisses your boo-boo when it hurts, i.e., spends money on the welfare state. Daddy drags home the mastodon he felled on the grassy plain with his mighty spear, i.e., manages the economy. This formulation couldn’t be more mistaken. As I noted last year (“No, Republicans Aren’t Better at Managing the Economy Than Democrats”), Democratic presidents consistently outperform Republicans on managing the economy. This isn’t anything new. It’s been true for the past century. Folks just don’t want to believe it.

But there’s another reason people can’t bring themselves to believe Biden’s doing a good job on the economy: It isn’t what the business press tells them.

Writing about Biden’s Wednesday speech in The Wall Street Journal, Greg Ip repeated the canard that Biden’s stimulus bill created a “surge in inflation that still hangs over Biden’s approval ratings and his prospects for re-election.” Ip also complained that Biden’s stimulus “wasn’t particularly novel” but rather was “old-fashioned Keynesian demand stimulus.” Since when do we evaluate economic policy based on its novelty? Ip conceded that inflation dropped over the past year from 9.1 percent to 4 percent. But he complained that “underlying inflation persists around 4 percent to 5 percent.” He was probably referring to the personal consumption expenditures, or PCE, price index, excluding prices for food and energy, which are highly volatile. Yes, the core PCE price index, the Fed’s preferred measure, was stuck at around 4.7 percent from January to May. But another prominent inflation measure that excludes food and energy—the core consumer price index—has been falling since September 2022. The only honest conclusion is that it’s hard to say what’s going on right now with core inflation.

It isn’t just the Journal. “Many forecasters,” wrote Ben Casselman Thursday in The New York Times, “both inside and outside the central bank, are skeptical that inflation will continue to ease as long as consumers are willing to open their wallets.” Are these the same forecasters who told Casselman that a recession was imminent in April, in December 2022, in July 2022, and in April 2022? It may be unfair to single Casselman out. He’s one of the more nuanced economic reporters out there, and it’s part of a reporter’s job to solicit expert opinion. But the Covid economy has defied economic forecasts so often that perhaps it’s time to de-emphasize predictions.

Ultimately the problem is that business reporters see everything as bad news. Gregg Easterbrook published a classic New Republic essay about this (“The Sky Is Always Falling”) in August 1989. Not much has changed since then. Bad news is self-evidently bad, and good news is bad because markets or regulators will overreact and spoil everything. The reasoning is essentially circular. Rising inflation is obviously bad, but falling inflation is bad too because it will encourage the Fed to slack off prematurely on raising interest rates, pushing inflation even higher than before. “Perhaps 95 percent of economic doomsday edicts,” wrote Easterbrook, “turn on constructions like ‘could lead to,’ ‘might cause,’ [or] ‘analysts warn of possible.’” Given the evident dangers lurking everywhere, it’s a wonder business reporters can get themselves out of bed in the morning. They’re also, Easterbrook pointed out, Fed-worshippers, envisioning our central bank as an all-powerful, vengeful Old Testament God whose inscrutable deeds must never be questioned. If Jerome Powell thinks inflation is still raging out of control—or pretends to think that lest the press declare the inflation crisis over prematurely—then reporters must fall in line. Not to do so would be sacrilege.

The truth, though, is that Biden has managed the economy very well. Perhaps he will mismanage it in the future. Perhaps he won’t. Perhaps the economy will defy Biden’s attempts to manage it at all. We don’t know what will happen. We can’t know. So we might as well judge Biden on what’s happened thus far. And that story is a happy one. Unemployment is low, GDP is rising, and inflation is falling. What’s not to like?

This article has been updated with new data released on Friday morning.