The Biden economy keeps bumping along, impervious to the Federal Reserve raising interest rates 10 times and Fitch threatening a downgrade of United States Treasury bonds. On Friday Richard Francis, Fitch’s senior director of sovereign ratings, told CNN that “governance is generally weaker” in the United States than in other triple-A nations. Who can disagree after Congress nearly put the government in default? But it doesn’t seem to matter. That same day the Bureau of Labor Statistics reported the creation of 339,000 jobs in May.

The economy is in excellent health, except if you talk to economists, who think that’s too good to be true. For a while they fretted that the economy was overheated and that inflation would spin out of control. Some blamed President Joe Biden’s $1.9 trillion stimulus bill; one such person was Olivier Blanchard of the Peterson Institute for International Economics. But although inflation did rise to 9.1 percent in June 2022, it’s been falling ever since—it’s now 4.9 percent—and in a recent paper, Blanchard teamed with former Fed Chairman Ben Bernanke to concede that he’d been wrong. The spike, they wrote, was attributable not to the Biden stimulus and its effects on the labor market but rather to price hikes caused by Covid-driven supply chain snafus, now abating. Inflation hawks can still point to the Fed’s preferred inflation measure, the personal consumption expenditures, or PCE, price index, which rose to 4.4 percent in April, the last month for which data are available. But one month is hardly a trend, and in other recent months the PCE has been falling.

As inflation cooled, the doomsayers shifted their attention to the likelihood of a recession. Last fall we heard a lot about the yield curve, which is the difference between yields on 10-year Treasury bills and three-month bills. A negative yield curve has predicted every recession since (depending on who you ask) 1969 or 1955. But this time, no recession came—not yet, anyway. Certainly it will come eventually, proving to some that the yield-curve augury was true. But that’s a little like disemboweling a live sheep in July and interpreting its viscera to foretell that the weather will turn cold.

In the meantime, the indicator du jour has become productivity. Productivity, or worker output per hour, is the engine of economic growth. It has been declining for an unprecedented five straight quarters. Nobody really knows why. But the news pages of The Wall Street Journal advised us last week to “Get Ready for the Full-Employment Recession.” In fact, argued Journal reporter Gwynn Guilford, the full-employment recession is already here, and reduced productivity—too many workers producing too little output—is the cause.

A recession is usually defined as two consecutive quarters of negative growth. We haven’t had that. Gross domestic product rose 2.6 percent in the last quarter of 2022 and 1.3 percent in the first quarter of 2023. Guilford’s recession pronouncement substitutes for GDP an alternative indicator for economic growth, gross domestic income, or GDI, which fell 3.3 percent in the last quarter of 2022 and 2.3 percent in the first quarter of 2023.

GDP and GDI measure the same thing—economic growth—GDP from the buyer’s perspective (how much did you spend?) and GDI from the seller’s (how much did you receive in wages and profit?). Logically these should be the same number, because (to paraphrase Paul Simon) one man’s purchase is another man’s sale. In practice, they aren’t, for complicated statistical reasons I don’t pretend to understand, but usually they’re pretty close. Right now they’re far apart, suggesting that the seller is somehow getting shortchanged. Guilford, the Fed, and a lot of economists think the problem is that too many people have jobs.

Remember the Great Resignation, when the “quit rate” peaked at 3 percent? That was in April 2022. Since then, the quit rate has been falling, and though it’s still elevated at 2.4 percent, nobody’s talking about a Great Resignation anymore. (It’s hard to say what a stable quit rate would be, because even before their pandemic spike, quits had been rising for a decade.) But bosses still remember how disruptive it was to lose employees left and right, especially in the health care, restaurant, hotel, and airlines industries. Determined not to let it happen again, these bosses, the theory goes, are hoarding labor, keeping more people on the payroll than they have work for them to do. Hence, falling productivity.

If we really are in or about to be in a full-employment recession, I’m not inclined to lose sleep over it. GDI may be down, but average hourly wages are still rising—not so fast as they were a year ago, and still not fast enough to keep up with inflation, but the latter gap is narrowing. When rising wages coincide with declining productivity, companies hike prices, causing inflation. For a while that was happening. But for a year now, inflation has been receding.

There are profits to consider. GDI measures the trend in both wages and profits, and profits are way down. But that’s just a return to real life after Covid sent corporate profits (mainly tech) into the stratosphere. In 2021 corporate profits rose 23 percent, even as unemployment shot up to its highest level since the Great Depression. The simplest explanation for why productivity is down now is that it rose too high during the Great Resignation. Waitresses and airline reservation clerks who didn’t quit were left with way too much work to do, increasing the quantity of their work (and therefore productivity) but compromising its quality pretty severely. Remember waiting half an hour in a greasy spoon to order a hamburger? Five quarters of productivity decreases may simply be what’s necessary to restore the economy to sanity after Covid drove it crazy.

And anyway, weak productivity growth isn’t exactly a new problem. Like the quit rate, it’s been a problem since the Great Recession, and, like the quit rate, it got a lot worse in response to Covid. The full-employment recession is a distraction. The real question is why productivity growth has faltered now for a decade. Nobody has an answer to that either, and that’s driving employers batty.

All the excited talk lately about driverless cars and artificial intelligence, at a time when these technologies are still way too new to assess their practical application, can be interpreted as a symptom of desperation over declining productivity. If the five senses and brains of human beings can’t boost output per worker-hour, the thinking goes, let’s demand more from machines.

Meanwhile, in Silicon Valley, tech tycoons are busily trying to rebuild human nature. Gone are the days when a coffeemaker is judged sufficient to keep employees creative and collegial. Now businesses are microdosing their top executives. Injecting your creative team with small amounts of the hallucinogen ketamine, Businessweek’s

Ellen Huet reports, is “gaining popularity as a way to maximize professional performance.” At so-called “ketamine retreats,” employees gather in a room, lie down on “fluffy blankets and pillows and slip on eye masks,” and are injected with 100 milligrams. “We hope to take them out of the healing-only realms,” Reid Robison, the chief clinical officer of a ketamine company called Numinus Wellness, Inc., told Businessweek, “and into healing and growth and ways of improving their lives.”

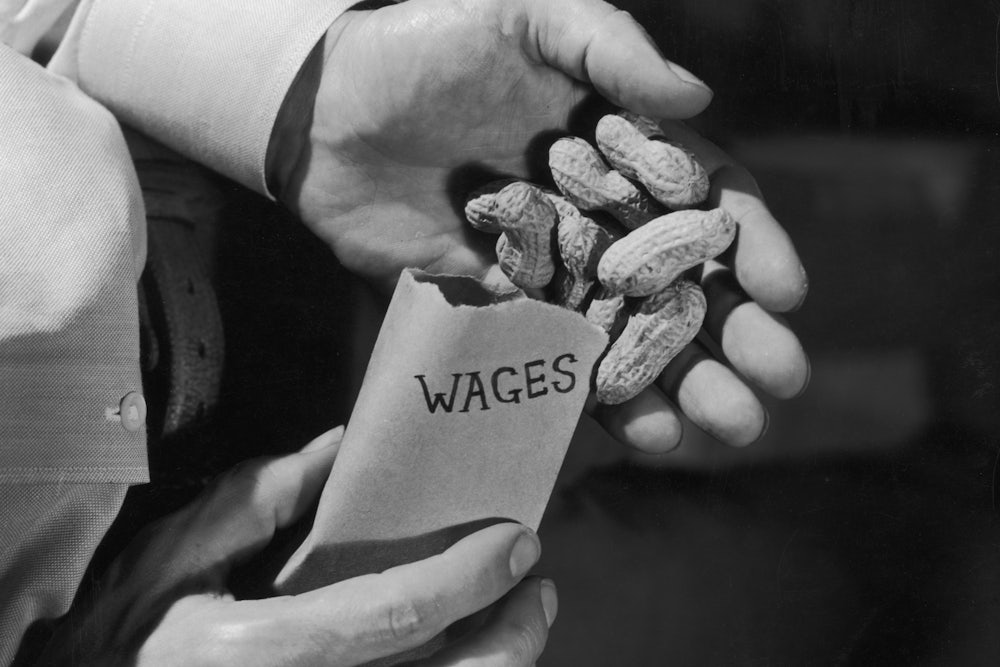

But I know a much better drug to motivate workers: money.

Employees may not need more money in Silicon Valley, but they do most other places. Private-sector wages and benefits stopped rising in tandem with productivity around the time Ronald Reagan entered the White House, and the gap has been steadily widening ever since. There were many reasons for this, but the decline of labor unions played an outsize role. Decoupling compensation from workers’ contribution to the bottom line was bound to undermine productivity eventually, and that finally happened a decade and a half ago. Productivity never really recovered from the recession of 2007–9.

Raising wages improves worker productivity. For one thing, it reduces turnover, a point Zeynep Ton makes in her new book, The Case for Good Jobs, about which I wrote last month. But higher wages also help workers focus on the task at hand. Here’s Boston University’s Ray Fisman and Harvard Business School’s Michael Luca, writing in 2018 in The Harvard Business Review:

Paying wages that are above the market rate (known within economics as “efficiency wages”) can … be an important motivating force for your existing employee base.… Workers have more to lose by slacking off—who cares if you’re fired from a $7.25 an hour job, but where else will you find somewhere that pays $15 per hour?

Yet another reason raising wages increases productivity is that it encourages capital investment. “When labor is cheap,” a 2016 report by Brendan V. Duke of the Center for American Progress explained,

businesses have little incentive to invest in capital because they can always hire another worker on the cheap. But higher wages reduce the price of capital relative to labor, nudging firms to make investments and raise productivity.

You want to see what A.I. and driverless cars can really do? Pay humans more. It sure beats the hell out of shooting them up.