Republican Senator Rick Scott professed bafflement last week that President Joe Biden is “obsessed with my plan to rescue America.” It’s true, he kind of is. On Tax Day, the White House released a fact sheet that said Scott’s plan would “increase middle-class families’ taxes an average of nearly $1,500 this year alone and take $100 billion out of the hands of middle-class families each year.” This week, Biden cited the Scott plan again in a speech attacking the Republicans’ “Ultra-MAGA Agenda.” Expect Biden to attack Scott’s plan repeatedly as the midterms draw nearer. I only wish he’d hit harder.

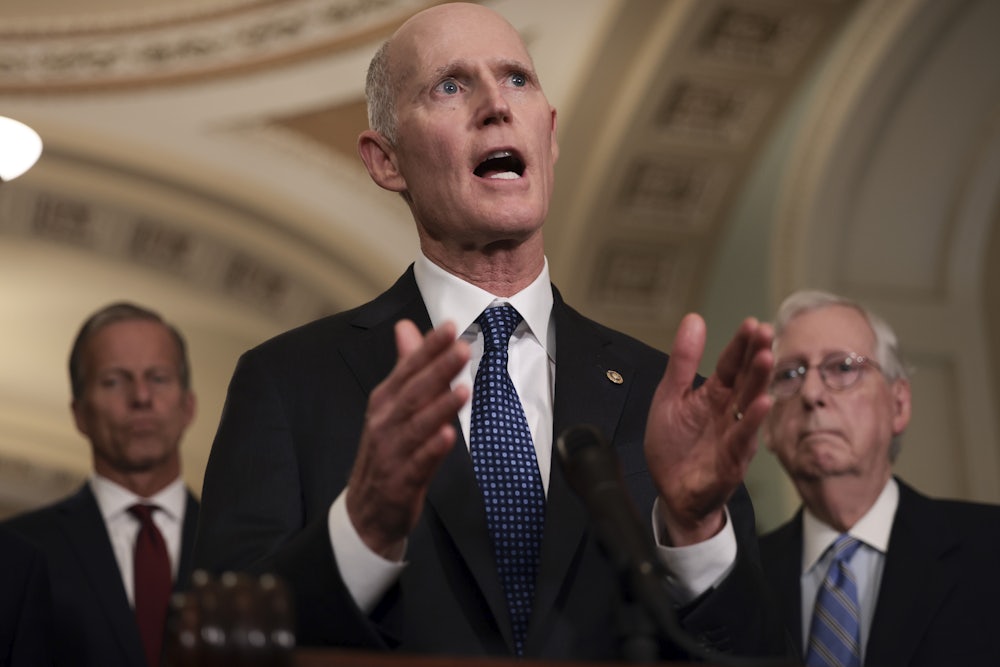

There are two reasons Biden is making a big deal about Scott’s Rescue America plan. The first is that Scott isn’t just some junior senator from Florida; he’s chairman of the National Republican Senatorial Committee. That makes Rescue America not just Scott’s plan but the Senate Republican campaign plan, even if it’s not an official NRSC document. (When you click on “Donate,” you’re invited to contribute to Scott’s own campaign fund.) Mitch McConnell is very unhappy that Scott is hawking this plan. Asked in March whether he endorsed it, the Senate Republican leader said no. “We will not have as part of our agenda a bill that raises taxes on half the American people,” McConnell said. Too late! It already was.

The second reason Biden is making a big deal about the Rescue America plan in general, and its tax increase in particular, is that it revives the idea that sank Mitt Romney’s presidential campaign in 2012—an idea even Romney wasn’t dumb enough to articulate publicly but that he instead shared en famille at a Boca Raton fundraiser captured on video and passed along to David Corn of Mother Jones. The idea is that poor people and the lower middle class don’t pay enough in taxes.

“All Americans should pay some income tax to have skin in the game,” the Rescue America document says, “even if a small amount. Currently over half of Americans pay no income tax.” Here’s the Romney version from 2012:

There are 47 percent … who are dependent on government, who believe that they are victims, who believe the government has a responsibility to care for them, who believe that they’re entitled to health care, to food, to housing, to you-name it.… These are people who pay no income tax. Forty-seven percent of Americans pay no income tax.

Actually, it was 46, but don’t let’s quibble. This cohort, Romney confided to his donors, was going to vote for President Barack Obama no matter what, because it didn’t have skin in the game. The idea was that the Democrats had put the 47 percent into a sort of political Skinner box that conditioned them to believe government was a source of benefits and imposed no costs. That was not a new Republican conceit. Back in 2002, a Wall Street Journal editorial (“The Non-Taxpaying Class”) had argued that a person earning $12,000 a year (about $19,000 in today’s dollars) who paid only 4 percent in income tax could not

get his or her blood boiling with tax rage.… As fewer and fewer people are responsible for paying more and more of all taxes, the constituency for tax cutting, much less for tax reform, is eroding. Workers who pay little or no taxes can hardly be expected to care about tax relief for everybody else. They are also that much more detached from recognizing the costs of government.

The Journal subsequently labeled low-income non-taxpayers “lucky duckies.”

The Republican subculture that wants to raise income taxes on lower-income people would dismantle one of the very few tax policies that enjoys long-standing bipartisan support: the Earned Income Tax Credit. The EITC was created by a conservative Democrat, Senator Russell Long of Louisiana, during the administration of a Republican president, Gerald Ford. President Ronald Reagan expanded it, and President Bill Clinton expanded it more. The Biden administration increased the refundable credit in its 2021 American Rescue Plan. Conservatives like the EITC because it rewards work. Liberals like the EITC because it lifts families out of poverty. The nonprofit Tax Policy Center has called it “the single most effective means tested federal antipoverty program for working-age households.” It’s also the largest.

The right-wing argument against the EITC and for raising taxes on lower-income people is that if you reeducate the lower orders to recognize that government costs money, you can pry them away from the Democratic Party. But no practicing politician is stupid enough to believe that. Were Republicans ever to jack up lower-income people’s taxes, the much more likely result would be a strengthening of these voters’ allegiance to the party that abhors such behavioral experiments on society’s most vulnerable. The actual appeal of “Tax the poor” to Romney then, and to Scott now, is that it demonizes the poor as shiftless and irresponsible. That’s a helpful message perhaps in a primary campaign, but a terrible message in a general election. Romney learned that the hard way.

Perhaps you wonder how we got from 46 percent not paying taxes in 2012 to more than half not paying taxes today. In a word, Covid. Before the pandemic, the non-taxpaying cohort had actually shrunk a little, to the low to mid-40s. During the pandemic, the cohort grew because people lost their jobs, because the stimulus checks weren’t taxable, and because the government extended various emergency tax credits (not just the EITC). Scott’s a bit of a hypocrite on this point because he voted for the 2020 Cares Act, which sent out many of those stimulus checks. But Scott voted against the follow-up stimulus bills in December 2020 and March 2021.

Scott’s embrace of Romney’s losing strategy is, for Biden, a softball pitched right over the plate. It allows Biden to depict Republicans as moral monsters. It allows him to demonstrate he’s the true friend of the working poor and the working class, and to sidestep any defense of the nonworking poor that might rub moderate voters the wrong way. (The nonworking poor are irrelevant to this conversation because they have no income on which to pay taxes.) In the Tax Day fact sheet, Biden said the Rescue America plan would “increase middle-class families’ taxes an average of nearly $1,500.” That’s a point Biden should have hit harder, because when you consult Biden’s source (a Tax Policy Center study), it’s apparent that he’s talking about the bottom 40 percent of the income distribution. That isn’t middle class in most cases; it’s poor. The NRSC plan would increase taxes by $1,020, on average, for the bottom 20 percent. That’s people who make less than about $30,000. The plan would increase taxes by $2,250 for the 20 percent above them. That’s people who make more than about $30,000 but less than about $55,000. Imagine squeezing people making this kind of money. It’s repugnant.

In this week’s speech, Biden again soft-pedaled the petty cruelty of the Rescue America plan by saying it would “raise taxes on 75 million American families, over 95 percent of whom make less than $100,000 a year.” Obviously, Biden was trying to convey that the NRSC wants to raise taxes on you, Mr. and Mrs. Middle Class, but that isn’t the outrage. The outrage is that the NRSC wants to raise taxes on people who may not be tuning in—people whose fondest dream is to earn enough to join the middle class. And it was a mistake for Biden to signal that 5 percent of the people who’d pay more taxes under the Rescue America tax-the-poor plan have incomes above $100,000 a year. If you make that much and you don’t pay taxes, I would certainly like to know why not.

Still, Biden is on the right track. There’s lots of other stuff to attack in the Rescue America plan, including a sunset provision that McConnell concedes could shut down Social Security and Medicare. But attacking the poor people’s tax is very rightly Biden’s first priority. Some news organizations fault Biden for associating it with “congressional Republicans,” given McConnell’s rejection of it. But give me a break. Scott is in the Senate leadership. He’s giving out money to Republican Senate candidates. That makes it a Republican plan. If some Republicans don’t like it, I can well understand why. But tough luck.