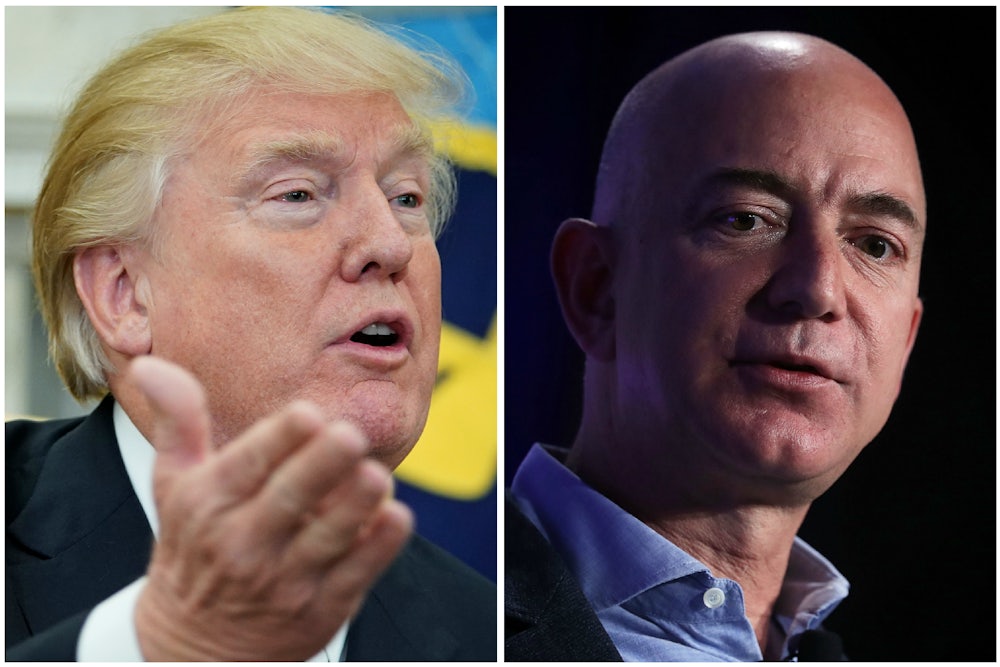

Amazon has a Donald Trump problem. For days now, the president has been tweeting about the online retail giant, accusing it of ripping off the U.S. Postal Service, shortchanging state and local governments on taxes, and using these unfair advantages to put countless retailers out of business. “Only fools, or worse, are saying that our money losing Post Office makes money with Amazon,” he tweeted on Monday. “THEY LOSE A FORTUNE, and this will be changed. Also, our fully tax paying retailers are closing stores all over the country...not a level playing field!”

Trump is almost certainly lashing out at Amazon because its CEO owns The Washington Post, which has been critical of his presidency. And this raises legitimate concerns about creeping authoritarianism.

“[A] President who routinely threatens prosecutorial or regulatory vengeance against private companies because they are not sufficiently politically subservient to him personally is entirely outside of our system of governance,” TPM’s Josh Marshall wrote on Sunday. “At present, Donald Trump is an autocrat without an autocracy. The system mostly resists his demands because it’s not designed to operate that way and we have centuries worth of norms that are remarkably resilient. But systems change. And it’s clear that ours is already starting to change under his malign influence.”

It’s valid to condemn government by vendetta. But I don’t think it logically follows that, as Marshall suggests, one must subordinate concerns about Amazon to concerns about Trump. That’s because Trump has been largely ineffective at bringing any company to heel, and in fact has bolstered Amazon quite a bit on his watch. Nor is Trump particularly interested in taking steps to make the playing field more level for retailers. But the most important fact to remember amid his spat with Amazon is that the government has been propping up the company for the entirety of its existence.

First off, the evidence that Trump is an autocrat, demanding fealty from private companies, is largely limited to mean tweets. The Republican tax overhaul that Trump signed last year could have singled out Amazon for harsh treatment, but the company still qualifies for every corporate tax break. In fact, under Trump’s watch, Amazon secured a change to federal procurement laws that will allow the Defense Department to purchase all commercial items on the Amazon marketplace. It’s also on the verge of winning a $10 billion cloud contract to host top-secret Pentagon data through its Amazon Web Services division. (There are rumors Trump may push the Defense Department to cancel that contract.)

What is the impact of the aforementioned mean tweets? Much has been made of the $54 billion in stock market value Amazon lost in the first day of Trump’s tweet tirade. “Trump’s attacks on Amazon are working,” CNN claimed. But analysts believe tech stocks are in free-fall because of the data privacy scandal consuming Facebook. Amazon has been largely caught in this backlash.

A day or two of stock trading doesn’t represent the big picture. Wall Street investors have been tuning out Trump’s tweets for the better part of a year. In nine case studies, author Kat Tretina saw no medium or long-term effect on companies targeted by Trump tweets. One of those case studies was Amazon. Trump tweeted about the company—largely along the same lines as he is now—in mid-August. Amazon stock rose 3.62 percent within a month.

Under a competent autocrat, Amazon might be in trouble because their business model is so dependent on government. Amazon obtained its market share through a simple pricing advantage: It never charged sales tax on online purchases, for close to two decades. As long as it didn’t have a physical headquarters or warehouse in a given state, it could enjoy a significant price advantage over brick-and-mortar stores. It earned its market share on the backs of tax avoidance.

Now that Amazon promises rapid delivery, it dots the landscape with warehouses and collects state-level sales taxes (though not local sales taxes, and not on third-party sales through its marketplace, which it profits greatly from). But as a condition of locating the warehouses, Amazon got the collection process delayed, deferred, and even reduced, stretching out the pricing advantage. This is part of a concerted effort to win subsidies from cities and states for every worksite—$1.1 billion since 2000—culminating in the obscene spectacle of the bidding war for its second headquarters, HQ2, with tax incentive offers worth billions and even a proposal to give worker income taxes to Amazon.

These new Amazon warehouses don’t increase overall employment in a region, according to a study from the Economic Policy Institute. And the warehouse workers are paid so little and given such limited hours that they often turn to government benefits, with Amazon effectively outsourcing their payroll to the feds, too. But Trump isn’t interested in fixing these tax inequities; he wants positive coverage from the Post.

As for the U.S. Postal Service, its net losses have nothing to do with subsidizing Amazon and everything to do with a law passed by Congress in 2006 that requires the agency to pre-fund retirement benefits 75 years out, for future workers who haven’t even been born yet. And the USPS does earn money from delivering packages the “last mile” for Amazon. But it’s also true that Amazon appears to be getting a sweetheart deal for using the USPS’s universal delivery network.

I say “appears” because the USPS has only released a heavily redacted copy of its Parcel Select contract with Amazon. But here’s what we know. Amazon got the post office to deliver on Sundays, using non-union, low-paid “city carrier assistants.” It has put the agency into high-stress situations, prioritizing Amazon packages over even Priority Mail. It’s hard to know what Amazon pays, but one report puts it at as little as $2 a package, with the volume enabling a better-subsidized rate. This grants Amazon yet another advantage over rival retailers; the more it ships, the cheaper the access to the government’s universal public infrastructure. A Citigroup report from last year stated that what the USPS charges Amazon for delivering packages is 41 percent below the market rate.

This contract expires in October, creating a prime opportunity for the Postal Regulatory Commission to properly price the service. Yes, Amazon is expanding its own package delivery, and might dump the USPS altogether if asked to pay premium rates. But that assumes Amazon can put such infrastructure in place. The post office goes to everyone’s house in America, six days a week. Amazon doesn’t have that ability. (Neither do FedEx or UPS; they use Parcel Select, too.) The company is borrowing government infrastructure on the cheap.

In other words, the power in this relationship probably lies with the USPS, not Amazon. And that’s true of Amazon’s relationship to the government overall. The question is whether lawmakers on Capitol Hill, who have been increasingly critical of the tech giants, will ever use that leverage.