Republicans are on the verge of passing a $1.5 trillion tax reform bill that would raise taxes for millions of middle-class families and cost 13 million people their health insurance—all to pay for massive corporate and upper-income tax cuts. A tax reform package has already passed the House; the Senate could vote on its bill as soon as Thursday. And yet, despite the fact that this legislation represents an enormous transfer of wealth up the income ladder, and has progressed with a shocking minimum of democratic transparency and accountability, it has not been treated as a massive scandal by the media.

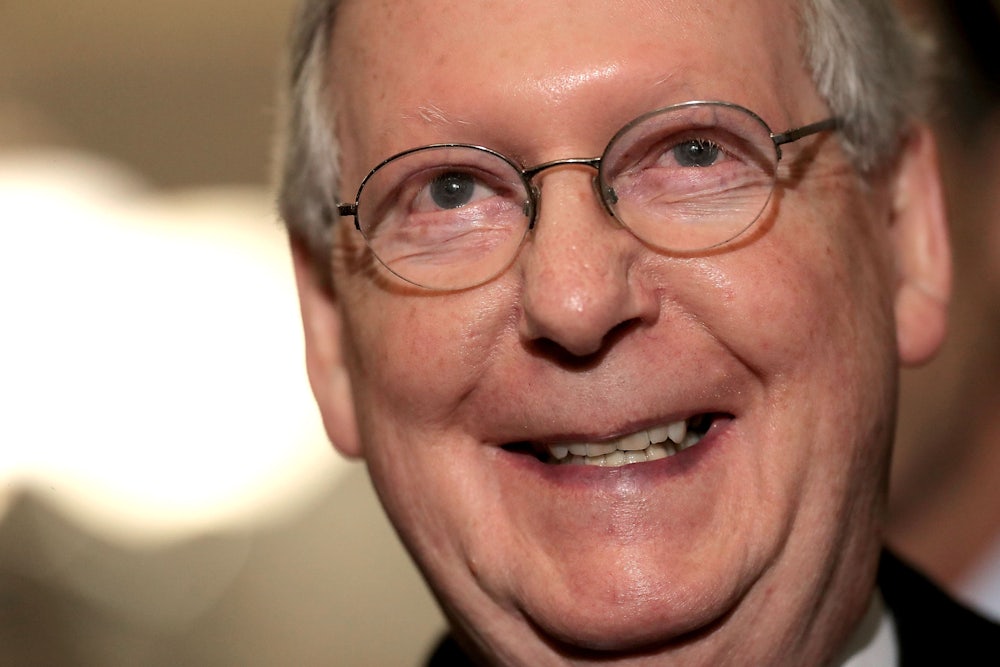

We’ve been here before. Back in July, when Senate Republicans were attempting to repeal Obamacare, Majority Leader Mitch McConnell’s chief insight was that the success of the bill depended largely on two factors: speed and stealth. With a news media distracted by an overwhelming number of scandals emanating from the White House, not to mention daily Twitter outbursts from President Donald Trump, McConnell had cover to craft sweeping legislation. And he very nearly succeeded in getting it passed.

With tax reform, Republicans are following a similar strategy, using non-stop crises as cover to push an odious bill through the House and Senate while the media plays Whack-a-Mole with the news of the day. They have also been abetted by a media that has failed to learn the main lesson of the Obamacare repeal effort, which is that the GOP is no longer a normal political party that is beholden to the welfare of voters. It has become so bankrupt that it is willing to use any means to pass unpopular, highly damaging legislation that will have little positive impact on anyone but a very thin slice of people at the top. But the coverage does not reflect that bedrock dynamic; instead we often see stories that focus on the GOP’s desperate need to pass “major” legislation before the end of the year, even if that legislation amounts to daylight robbery.

To be fair, Republicans enjoy two advantages they didn’t have when they attempted to repeal Obamacare over the summer. The first is that the last month has featured a number of high-profile, evolving news stories—most notably the fallout from the Harvey Weinstein sexual harassment scandal—that have shifted to new figures on a practically hourly basis. This allows a less explosive issue like tax policy to fly below the radar. On Sunday’s Meet The Press, for instance, both Democratic Minority Leader Nancy Pelosi and Republican Senator Rob Portman spent the majority of their time answering questions about sexual harassment and Roy Moore, respectively—both had to push Chuck Todd to give them extra time to discuss tax reform.

The other advantage is that the effects of the tax reform bill are more complicated than the effects of Obamacare repeal. Obamacare repeal had stark repercussions that activists, politicians, and the media could latch onto: It would cost 24 million people their health insurance. The tax reform bill, meanwhile, effectively sticks middle-class taxpayers with the bill for massive corporate tax cuts after giving those same taxpayers modest income tax decreases. The mechanisms involved are complicated—tax policy combined with the arcane rules of the Senate do not exactly make for thrilling cable news coverage. And because the House and Senate bills are so different, journalists and networks have struggled to convey what’s happening.

Republicans are using this ambient confusion to their advantage. The process being used to pass this bill is proof enough: They are ramming a bill through Congress that will dramatically alter the tax code in roughly a month, with minimum input from nonpartisan observers. The last time tax reform passed, in 1986, the effort effectively took two years and enjoyed broad bipartisan support. This tax reform effort, which is being pushed through committee with almost no markup or input, is nothing less than an undemocratic assault on longstanding norms.

A crowded news cycle; a complicated bill; a sneaky and rapid process that lacks any semblance of “regular order”—all of these things have combined to create the perfect environment for passing sweepingly bad legislation. Indeed, the contents of the tax reform effort are disastrous from both a policy and an electoral perspective—it’s hard to think of a more self-defeating move than stealing from the middle class to give to the rich, and polls bear this out. As Representative Chris Collins of New York admitted, “My donors are basically saying, ‘Get it done or don’t ever call me again.’”

So naturally Republicans are saying they are cutting taxes for the middle class as well, even though independent studies are nearly unanimous in saying this is not the case. When Portman followed Pelosi on Meet the Press, for instance, he insisted that the tax cut is for everyone, not just for the rich. “Everybody in every group, Chuck, in every bracket that group as a whole will see tax cuts and so it’s just been misrepresented and I hope people will go online and look for themselves,” Portman insisted.

Republicans have repeatedly pushed the “group as a whole will see tax cuts” argument, and the news media has largely allowed them to do so unchecked. Republicans cherrypick average data and “typical families” to make their plans seem much better for the middle class than they are—especially given that the middle-class tax cuts expire, unlike the corporate tax cuts or the House’s elimination of the estate tax.

But research done by The New York Times—research that takes time that many journalists have not been allowed, given the speed at which the bill is moving through Congress—tells a different story, in which middle-class taxpayers and families are affected in profoundly different ways, with some paying higher rates, and some paying lower rates. According to the research done by the Times, taxpayers who take the standard deduction would largely see decreases, but it’s a mixed bag for those who itemize. Most middle-class taxpayers, however, would see a tax increase in 2027, and none would see a tax cut.

The Republican rush to pass this bill has largely obscured what’s in it. The urgency is primed by media coverage suggesting that Trump will be deemed a failure if he does not notch a legislative achievement by the end of the year, with consequences for the GOP in the 2018 midterms and beyond. This is, of course, normal political coverage—the media’s fixation on the horse race is not new, nor is its tendency to treat major votes like sporting events. But these are not normal times and this is not a normal legislative process.