Even by the standards of 2017, last week was a bad one for Republicans. They lost big in elections across the country that were seen as referendums on both Donald Trump and Republican legislative priorities, particularly the repeal of Obamacare. On Thursday Roy Moore, the Alabama Republican running to fill Attorney General Jeff Sessions’s Senate seat, was reported to have molested a teenage girl (and pursued relationships with a number of teenagers) decades ago. But there was one seeming bright spot in a week that otherwise spelled all kinds of doom for the GOP: Congressional Republicans were moving ahead with tax reform.

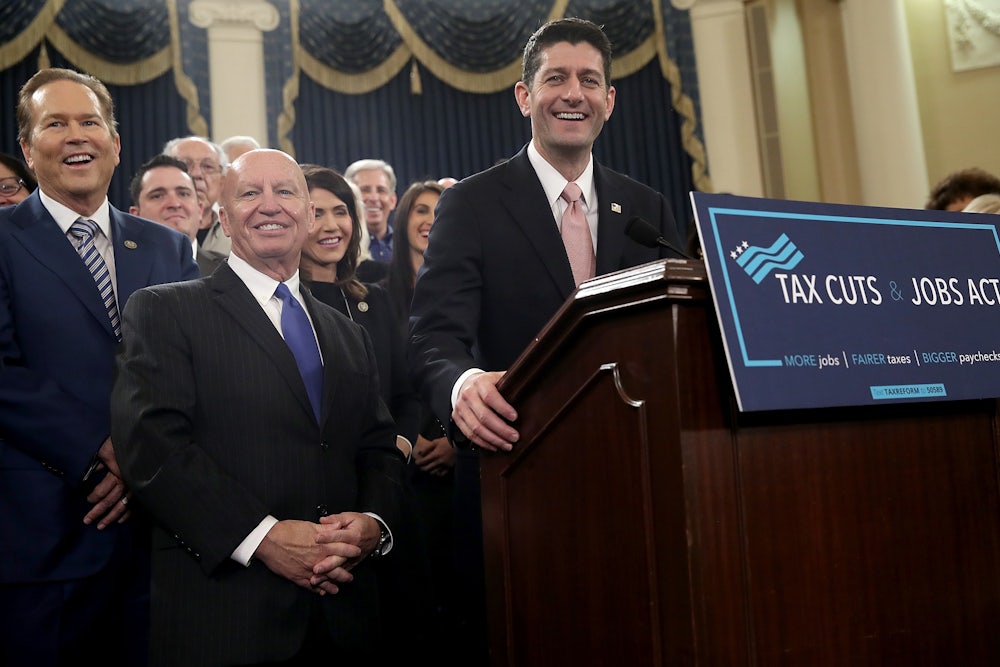

“It’s been a week of remarkable progress,” said Michael Steel, a spokesman for former Speaker John Boehner who now is the managing director of the consultancy Hamilton Place Strategies, after the Senate unveiled a $1.5 trillion tax plan heavily skewed toward corporations and the wealthy. And Republicans say its recent setbacks only add urgency to pass the legislation as soon as possible. Speaker Paul Ryan insisted that Ralph Northam’s massive victory in Virginia’s gubernatorial election was a sign that voters were punishing Republicans for not doing enough to pass their agenda. “The way I see it, honestly, is that we just have to get our job done,” Ryan said.

But despite the GOP’s outward optimism, the path to tax reform keeps getting narrower. Much of this has to do with the complications that Moore has brought to the proceedings. In the Senate, the GOP has a slim majority, and can only afford to lose three Republican votes; if Democrat Doug Jones defeats Moore in a special election on December 12, the magic number would shrink to two. Given the sheer number of wild cards in the Republican caucus—Jeff Flake, Bob Corker, John McCain, Lisa Murkowski and Susan Collins all may vote against this bill—and the fact that Rand Paul may be out of action following a mysterious assault in his home state of Kentucky, passing a bill before December 12 is becoming a priority.

However, the underlying reason tax reform is looking increasingly unlikely is that the House and Senate’s respective versions are different enough that they will be hard to reconcile without alienating some crucial GOP faction. Republicans have repeatedly insisted that tax reform will be easier to pass than health care reform, owing to the fact that Republicans are more comfortable cutting taxes than uninsuring tens of millions of people. But tax reform is enormously complicated, made more so by the GOP’s unified insistence on a massive tax cut for corporations that makes the legislative math near impossible.

To some extent, the differences between the House and Senate tax reform bills, as The Week’s Jeff Spross wrote last week, reflect existential differences between the two chambers. The House’s bill is a tad more populist and attuned to immediate political concerns, while the Senate’s takes a longer view. But they also reveal fundamental disagreements over how to finance deficit-exploding cuts that have a vanishingly small number of ways to be financed.

That is most apparent in the treatment of state and local tax (or SALT) deductions, which allow taxpayers in high-tax states like New York, New Jersey, and California to deduct property taxes on their federal returns. The Senate’s bill completely eliminates SALT deductions, while the House’s bill partially repeals them. This represents a political difference, not a philosophical one: There are a number of Republicans representing high-tax states in the House, but none in the Senate. And it could be a major sticking point. “Repealing the state and local tax deduction is just not a policy that will make its way through the House side,” Tom Reed, a Republican from upstate New York, told CNN last week. “The Senate indications that they may potentially do that, I just don’t see how that math works to get to tax reform.”

When House Republicans passed a budget blueprint in late October—the first step in the tax reform process—20 Republicans from high-tax states rebelled. The measure still passed, but with a razor-thin two-vote margin, giving Paul Ryan almost no margin for error.

If SALT deductions were the only pressing concern, Republicans could perhaps find a way. Unfortunately, there are a host of other significant differences, each of which could cause other Republican constituencies to rebel. The Senate bill delays cutting the corporate tax rate (again, as a cost-saving measure) until 2019, while the House bill cuts it to 20 percent immediately. The House bill eliminates the estate tax entirely, while the Senate bill keeps it, though it does make more families exempt.

The Senate bill keeps the popular medical expenses deduction, which the House bill does away with. On the other hand, the House bill cuts the cap for the mortgage interest deduction in half, from $1,000,000 to $500,000, while the Senate bill keeps it intact. SALT deductions may disproportionately impact voters in blue states, but there are wealthy homeowners everywhere.

Ordinarily, one would expect all these differences to be resolved over time. Republicans could offer middle-income families an actual tax break to entice Democrats, or shrink the size of the cut for corporations to make the math work. But the Republican Party is constrained by two central factors: the demand from donors and anti-tax ideologues for a huge tax cut, and Senate rules that require Republicans to contain the damage to the deficit if they want to pass tax reform with a simple majority. Indeed, the math is so tight right now that, according to The New York Times, one-quarter of middle-class families will see a tax increase next year under the Senate bill—mostly to line the pockets of the wealthy. Under those circumstances, it’s not difficult to see two to three Republican senators abandoning ship.

As Republicans stare down what is shaping up to be a calamitous midterm election season, they are responding to all of these political, procedural, and policy pressures by blindly pushing the process forward. We’ve been down this road before: Senate and House Republicans rushed forward with lousy Obamacare repeal bills that ultimately could not be reconciled. With the clock ticking and pressure building, it looks like they’re headed toward a similar disaster.