There is an old saying about currency markets: “The only certainty is that the exchange rate will fluctuate”. So increased fluctuations in the currency market in the build-up to the UK’s referendum on EU membership are not unexpected. The levels of volatility, however, are unprecedented in recent times.

As the June 23 referendum approaches, traders have been speculating both on the direction of movement of the British pound against currencies such as the dollar, euro and yen, and also on the amount of volatility that is likely to occur in each of these currency pairs on an hourly, daily, weekly and even monthly basis.

In the early days, following the referendum announcement on February 20, many assumed that the remain camp would win out. But the opinion polls now indicate a much greater chance of Brexit. This means that there is now much greater uncertainty in the market.

This uncertainty is being reflected in increased foreign exchange market volatility, especially for the pound. This makes it much more expensive for companies to hedge the risk of a large movement in the pound against currencies such as the dollar and the euro.

For instance, according to the markets, the current US$1.42/£1 exchange rate of the pound has a 95% chance of ending up in the region of US$1.55/£1 to US$1.29/£1 over the next week – a potential 9% movement. Over the next two weeks, which now covers the referendum result, there is a 95% chance of it ending up in the region of US$1.94/£1 to US$0.90/£1 – a dramatic 36% movement one way or the other.

These potential extremes are unprecedented in recent times and reflect the high degree of uncertainty about the outcome of the referendum result.

Risk assessed?

Unsurprisingly, many large firms have been assessing the risk they face from such large potential movements in order to manage their currency exposure. A large depreciation of the pound could eventually boost exports and reduce imports, but significant order changes for exports and imports could take 12 to 18 months to occur. In the meantime, a depreciation of the pound raises the cost of imports, pushing up the inflation rate.

Exchange rate volatility, however, is only likely to hurt international trade volumes if it persists for a significant period of time, as companies can manage risks over the short term by using futures and options contracts. Futures contracts guarantee a company a certain exchange rate in, say, three or six months. Options contracts give the company, in return for an upfront premium, the right to buy or sell a currency at a particular exchange rate in the future.

Most large multinational companies will have already expected much higher volatility than normal in the run up to the referendum and taken out contracts to manage their risk exposure for the next six months to a year. They will not be too greatly affected in the short-term, whatever the result. Some, however, will not have done so and will find their profit and loss accounts will be heavily affected by large currency movements.

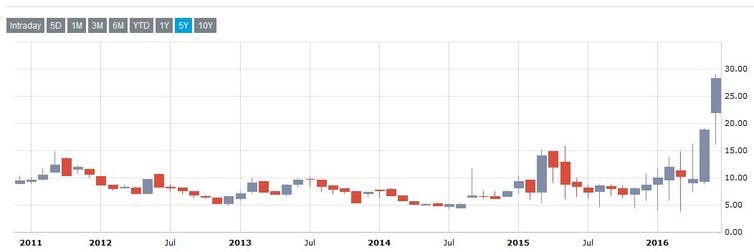

The increased uncertainty over the last two months about the result means the cost of buying protection against a large shift in the value of the pound has increased dramatically – as is shown in the chart above.

A red candle indicates expected volatility is down for the month with the wick indicating the highest and lowest volatility forecast for the month, while a grey candle indicates volatility is up for the month with the wicks again indicating the highest and lowest points for the month. It is now much more expensive for companies to protect themselves against large currency movements than in early May, for example.

There are a number of reasons why I think leaving the EU would be a disaster for the UK economy and its citizens. But the currency effect does not rank highly among them.

When the referendum result is known, sterling will either strongly appreciate on a remain vote (to perhaps US$1.55/£1) or depreciate (to perhaps $1.25/£1) on a Brexit vote. If it’s a vote to remain, volatility will likely return to much lower levels.

But if it’s a Brexit vote, a high degree of volatility should be expected for a prolonged period of several months. Some currency speculators will make large profits and others will make large losses once the result is revealed. Eventually, however, there will be a period of tranquillity until another major event hits the currency markets.

![]()

This article was originally published on The Conversation. Read the original article.