Back in November, Hillary Clinton responded to criticisms of her Wall Street ties by pointing out that, as a senator from New York who had represented the state before and during 9/11, she was obligated to represent their interests. It was perhaps the most curious notion adduced in the Democratic race up to that point, and the oddity of Clinton’s reasoning did not escape notice. It was the kind of bizarre statement that critics like to linger on, and repurpose for useful attacks. But for Clinton it has turned out to be worse than ammunition, not for what it was but for what it wasn’t: In the end, it simply wasn’t a satisfactory answer. It did not decrease interest in her relationship with Wall Street, or mollify voters concerned about her ability and willingness to handle big banks and the financial industry.

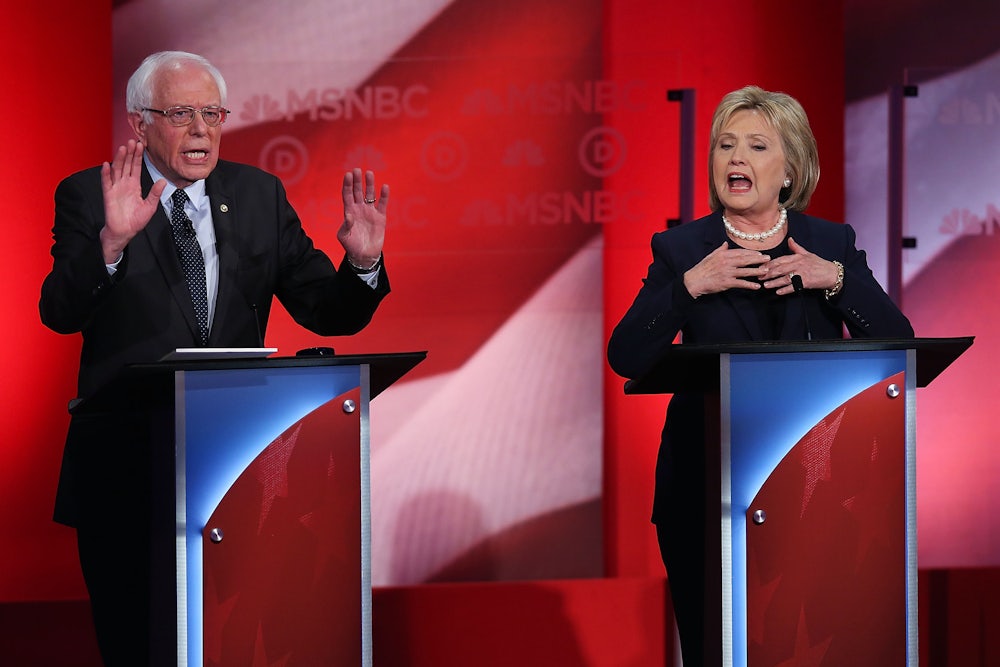

In the first hour of Thursday night’s Democratic debate in New Hampshire, two questions targeted Clinton’s history with banks. MSNBC’s Rachel Maddow pointed out that the “most frequent area of concern” reporters hear from voters leaning toward Sanders is whether Clinton has been “too close to Wall Street.” Maddow asked Clinton if she has been too dismissive of voters’ concerns in that regard, including the $675,000 that Goldman Sachs paid her in speaking fees. A little while later, co-moderator Chuck Todd read a question from a voter who wanted to know if Clinton would release the transcripts of her speeches to Goldman. Todd observed that transcription services had been used at those speeches, meaning that transcripts likely do exist.

Clinton, for perhaps the first time in the debate, faltered.

“I will look into it,” she said. “I don’t know the status, but I will look into it... But, I can only repeat what is the fact, that I spoke to a lot of different groups with a lot of different constituents, a lot of different kinds of members about issues that had to do with world affairs...”

It was a marked departure from her former efforts to explain the speaking fees. Gone were the shadows of the twin towers, the uniqueness of her relationship to an important New York industry. Instead Wall Street had become, in Clinton’s parlance, “just one street,” just one industry among many, one problem among many, one stop on the speaking circuit among very many.

The brush-off didn’t quite land. Nor did Clinton’s other defense, aired earlier in the debate: that she simply isn’t moved by large sums of money. “You will not find that I changed a view or a vote because of donations I received,” she said early on to Bernie Sanders. “So I think it’s time to end the very artful smear that you and your campaign have been carrying out in recent weeks.” On Twitter, observers seemed less than convinced.

Hillary's position: if you take Wall Street $$$ & are criticized for it, that's an unfair smear. Should that go in the platform, Democrats?

— Conor Friedersdorf (@conor64) February 5, 2016

Is Hillary Clinton's pitch that voters should share her outrage that Sanders is bringing up her speaking fees? #DemDebate

— Amy Davidson (@tnyCloseRead) February 5, 2016

If HRC is so adamant that donations, in theory, need not influence votes, why does she support (in theory) campaign finance reform?

— Evan Goldstein (@egoldstein93) February 5, 2016

Otherwise Clinton mainly cited “vigorous agreement” with Sanders, claiming that both of them are wary of Wall Street power over the economy, based on the example set by the Great Recession.

“We have a law,” Clinton said, “It was passed. It was signed by President Obama— It lays out a process that you go through to determine whether a systemic risk is posed...So we have a law in place. If the circumstances warrant it, I know I will certainly use it.” It was the second time in the debate she had said she would break up big banks if “they prove to be a systemic problem,” and the second time she alluded to Obama having less-than-pure progressive credentials by Sanders’s standards, having received Wall Street money himself.

Again, neither point quite represented “vigorous agreement” with Sanders. First, Sanders believes Wall Street is already a systemic problem. “This is what a rigged economy, and a corrupt campaign finance system is about,” Sanders said. “These guys are so powerful that not one of the executives on Wall Street has been charged with anything after, in this case, paying a $5 billion fine. A Wall Street executive destroys the economy ... and has no criminal record. That is what power is about, that is what corruption is about, and that is what has to change in the USA.”

Second, though Sanders himself did not call Obama out for failing to handle big banks harshly enough, he did cite Senator Elizabeth Warren, who has lodged just such a critique of the president. According to the International Business Times,

“In the financial crisis of 2008, it was fraud right down at the heart of that crisis, and yet not one major bank executive was even charged, much less prosecuted and taken to trial — not one,” she said. Noting that the federal government prosecuted hundreds of Wall Street executives after the Savings and Loan scandal a few decades ago, she said, “You’re telling me that something changed between the 1980s, when more than a thousand people got prosecuted in the Savings and Loan crisis, but by 2008, a far bigger financial crisis involving far bigger and bolder frauds, that no one was legally responsible for that? That’s just not possible.”

Warren’s critique, that Wall Street executives can commit crimes with vastly greater impacts than the average drug-buyer but face drastically fewer consequences, mirrors Sanders’s insistence on the same (which he made during Thursday’s debate).

Meanwhile, despite Clinton’s having cancelled scheduled fundraising events with Wall Street firms amid criticism from the Sanders campaign, Democratic supporters inside those firms are, according to CNBC’s Eamon Javers, not concerned about her loyalties. And close examinations of her record on Wall Street reveal a far warmer attitude toward big banks than the one Sanders advances.

It all adds up to a disturbing picture for the future of Clinton’s campaign. Like her 9/11 answer in November, her new strategy on Thursday night to downplay her relationship with Goldman Sachs and to win trust for her plans for Wall Street regulation will likely fail, if not backfire. And despite her insistence that she stridently agrees with Sanders on how to address Wall Street, the two differ in both tone and tactics, something voters aren’t likely to miss. Lastly, this particular effort at wrapping up the Wall Street question on Clinton’s behalf has the potential to call her opposition to Citizens United into question, given her claim that money in politics shouldn’t necessarily be read as a corruption threat.

Sanders didn’t buy it. “Why in the 1990s did Wall Street get deregulated?” he asked rhetorically. “Did it have anything to do with the fact that Wall Street spent billions of dollars on lobbying? Well, some people might think it does.”

And after this debate, it seems unlikely those people will be any less convinced.