Democrats have often argued over the past few years that fracking—the technological process of drilling into shale rock to remove oil and natural gas—has not had a significant effect on energy prices in the United States. The collapse in oil prices over the past six months, they argue, is the result of weak demand in Europe and China, not increased supply in the U.S. For oil, those arguments are largely right; its price is set on the global market and therefore weak worldwide demand has had a disproportionate effect.

Natural gas, though, is a different story altogether. Because American producers must turn it into liquid and receive a permit from the U.S government before shipping it overseas, prices are generally set on a regional basis. As domestic natural gas production has risen over the past few years, it has driven down the price of gas in the United States, which continues to benefit millions of Americans. However, whether that’s worth the environmental cost is a different debate.

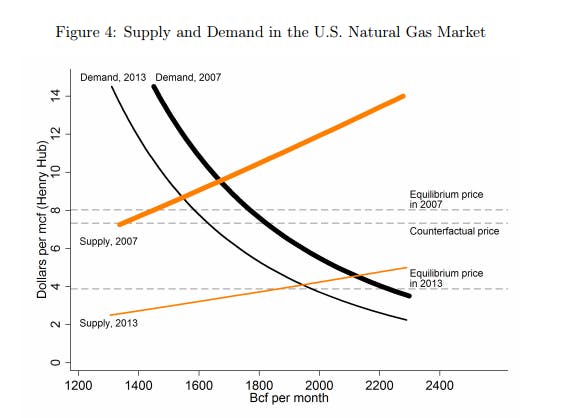

On Thursday, at the Brookings Institute’s spring conference on economic activity in D.C., the University of Michigan’s Catherine Hausman and Ryan Kellogg presented a paper titled “Welfare and Distributional Implications of Shale Gas”. In it, Hausman and Kellogg calculate supply and demand curves for the U.S. natural gas market in 2007 and 2013 and then plot the equilibrium prices in each year.1 Since they want to see what effect the change in supply had on price, Hausman and Kellogg created a counterfactual. In other words: If we hold demand for natural gas constant from 2007 to 2013, how would changes in supply affect its price? The “Counterfactual price” dotted line in the graph below represents the authors’ estimate, the price of gas in 2007 using the 2013 demand curve.

As you can see, natural gas would have been $7.33 per mcf (1,000 cubic feet of natural gas) in 2007, if you used the 2013 demand curve. In 2013, the actual price was $3.88 per mcf. The expansion in supply from 2007 to 2013 lowered the price of natural gas by $3.45 per mcf, or 47 percent.

From there, the authors used the supply and demands curves to estimate the welfare effects of fracking. They found that “the shale gas revolution led to an increase in welfare for natural gas consumers and producers of $48 billion per year.” That’s equal to about one-third of 1 percent of GDP, or $150 per capita. “If that doesn’t convince you [that it’s a lot],” said one participant made anonymous under Chatham House rules, “use Washington accounting and call it half a trillion dollars over 10 years.”

It’s a big increase. But that doesn’t say who received those benefits, or whether they outweighed the significant costs of fracking itself. Fortunately, Hausman and Kellogg attempt to answer those questions as well. They find that fracking benefited residential consumers by $17 billion per year, commercial customers by $11 billion per year, industrial customers by $22 billion per year, and electric power customers by $25 billion. That’s $74 billion in benefits for energy consumers—meaning that fracking has actually been harmful to producers. The gains from increased production have been more than offset by the losses from lower prices at existing wells.

The authors also seek to tally the environmental costs of fracking but have a far tougher time doing so. They estimate the global environmental impact using a varied set of assumptions, like whether natural gas production displaces coal production or not. That creates a wide range of potential costs: from $0.8 billion a year of savings to $28 billion a year in increased environmental costs. The authors also say that other considerations, particularly those on a more local level, should be accounted for. Hausman and Kellogg were unable to do so, due to data limitations. As one economist said at the Brookings event: “I think about this as the benefit side of a cost-benefit analysis.”

What should liberals think about this? Even without knowing the local costs of fracking, it’s likely that their financial benefits surpass their costs. If you only focus on the benefits to consumers it’s even more likely—again, since fracking appears to actually have hurt U.S. producers. That certainly doesn’t obviate the need for strong environmental rules for fracking that will limit the ecological damage. (In fact, on Friday, the Obama administration released new rules on fracking, which The New Republic’s Rebecca Leber explains here.)

Just because the benefits of fracking are real and substantial doesn’t mean that we should ignore the environmental damage the drilling process does. We can account for the environmental costs of fracking while still ensuring that consumers benefit from it. It just requires smarter policymaking.

Since the U.S. is a net importer from Canada, quantity demanded exceeds quantity supplied.