Marketplace might be the only news outlet to still use the term “trickle down.” Unironically. In 2014.

Though invented by Will Rogers and used almost exclusively as a joke since, the term is most associated with President Reagan’s economic program of slashing taxes for the richest Americans and waiting for their gains to percolate to the rest of us.

Reagan and his acolytes hardly ever used the term, preferring “supply side economics,” which onetime rival, later VP George H.W. Bush derided as “voodoo economics." But “trickle down” stuck, as a sarcastic descriptor for the distributional legacy of Reagan’s two terms in office, which saw the share of national income grow for the top 20 percent of earners and shrink for everyone else.

But it’s a different economic term that brought trickle down out of hibernation for public radio listeners: the multiplier effect.

Monday’s episode of Marketplace, the business news program broadcast daily on public radio stations, explored this concept, a cornerstone of Keynesian economics most commonly applied to fiscal policy. It’s the idea that each dollar a person (or, in a policy context, the government) spends has an impact on the economy as a whole beyond its immediate recipient, since spending your money puts money in other people’s pockets, who go out and spend more as well. Left-leaning economists like Paul Krugman point to multiplier effects when calling for things like stimulus bills and safety net programs for the poor, though the idea extends to private actors too, with wage hikes by businesses or microloans by banks in Bangladesh spurring broader economic development.

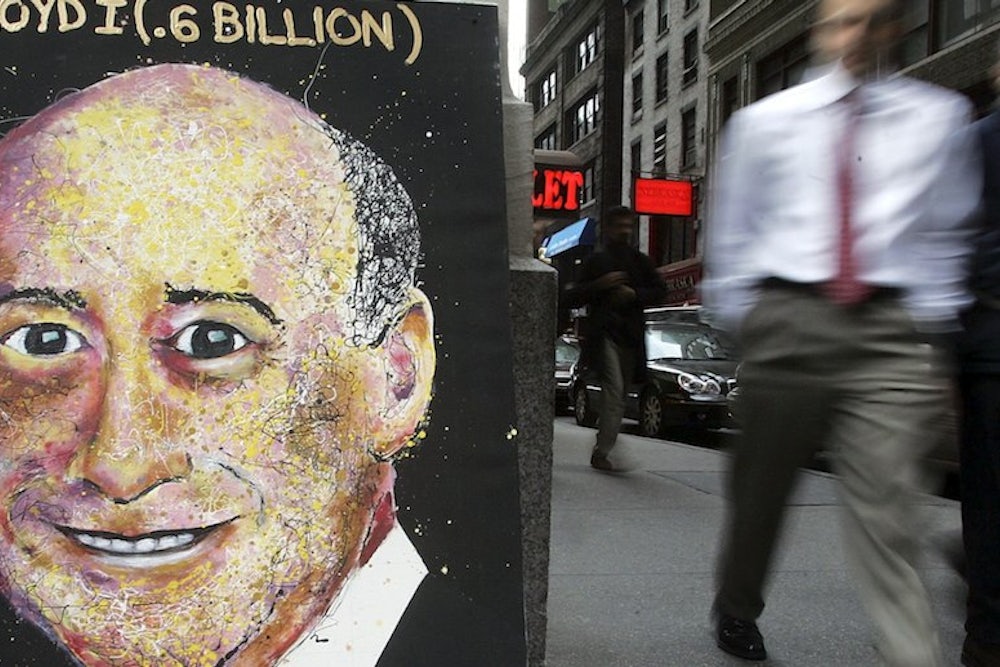

Given the ongoing debates about unemployment compensation, the minimum wage, and the low wage retail and fast food workforces, one could think of about a dozen news items pertinent to a discussion of multiplier effects. Marketplace chose to illustrate this concept with...Wall Street executive bonuses.

This is how it works, as reporter Mark Garrison describes it:

A big bonus banker orders a fancy steak dinner from a server, who uses the big tip to splurge on new home furnishings. Everybody wins.

Thus the best way to keep the economy humming is making sure those bankers keep getting their six- and seven-figure year-end bonuses:

For regular people whose jobs depend on them, big Wall Street bonuses aren’t excessive. They are absolutely vital.

Defending Wall Street bonuses is nothing new for Marketplace or for Garrison, but citing multiplier effects to do so strains logic. This is because what determines the size of a multiplier effect is one’s marginal propensity to consume (MPC), how much an increase in income affects your spending habits. And it’s fundamental to economic models and empirical studies that MPC is greater for poor people than it is for rich people. The poorer you are, the more unmet needs you have, so the more of what you earn you spend rather than save. Thus putting another dollar in the hands of a poor person will lead to more economic activity than giving it to a rich person. To be sure, putting another dollar in the hands of a wealthy banker has some impact—someone has to do the paperwork for that offshore tax shelter—but if your primary goal is stimulating the economy, you can have a greater impact giving that bonus to practically anyone else, or doing just about anything else with that money besides setting it on fire.

That is assuming, of course, your goal really is stimulating the economy, and not defending the pecuniary interests of the banking sector. There may be some normative argument for why the rest of the country is wrong to question whether wealthy bankers deserve to collect such lavish bonuses after having engineered the greatest financial collapse in recent memory. There doesn’t seem to be an economic one. Perhaps next time Marketplace should turn to theology, and give us a primer on the prosperity gospel.

Correction: This piece originally referred to Marketplace as a National Public Radio program. Although it runs on NPR affiliates, it is produced by American Public Media.