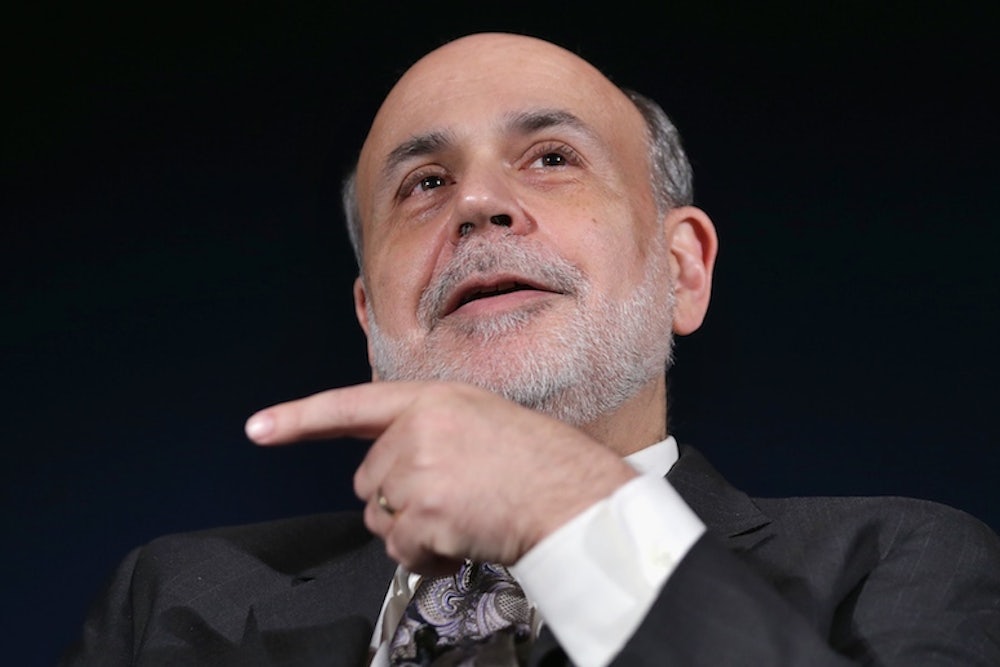

Bitcoin broke $1,000 last week after Fed chief Ben Bernanke told Congress that virtual currencies “may have long-term promise.” Bitcoin is, of course, the most famous virtual currency. People can use bitcoins—which are just strings of numbers—to buy goods and services by transferring them electronically across the Internet. Enthusiasm about bitcoin has soared with its price, but the theories as to why are as speculative as the currency itself. Many critics see a bubble based on the greater fool theory that if I pay something for a worthless asset I can make profits by reselling it at a higher price to someone more foolish than I am. Other former skeptics, like Business Insider's Joe Weisenthal, are coming around. To cut through the confusion, one needs to see that there are two different theories as to how bitcoins work—a wrong theory which is driving the excitement, and a banal theory which may leave a marginal place for bitcoin in the financial system.

The exciting, wrong theory is that bitcoin will become a self-sustaining currency that replaces fiat currencies like the dollar, yen, and euro. People will prefer bitcoins to regular currencies because those currencies are controlled by central banks, and hence ultimately governments, which from time to time find it irresistible to use inflation to finance wars, bridges-to-nowhere, and other foolish projects. Because the supply of bitcoins is limited, there is no inflation risk. The price of bitcoins has taken flight because investors believe that people will eventually see the advantages of virtual currencies and scramble to acquire them for their virtual piggy banks.

The problem with the argument is that the money supply needs to be flexible so that the government can address economic ups and downs. Bitcoin’s supply is fixed by algorithms that require increasingly immense computer power to mine new coins. The various experiments with currencies that are fixed to something out of the control of a government (gold and foreign currencies) have always ended in tears, usually when an economy enters recession and the government finds itself unable to devalue the currency in order to stimulate exports or domestic investment. In the unlikely event that bitcoin ever threatens the dollar, the U.S. government would shut it down. And if somehow bitcoin nonetheless thwarted efforts by the government to control it, it would surely be a victim of its own success, as other virtual currencies would flood the market, resulting in a volatile situation in which exchange rate risk—a problem faced by exporters and importers—would exist at home as well. Indeed, at least 30 virtual currencies have already entered the market.

In response to those who have argued that bitcoin is inherently deflationary because the supply does not grow as rapidly as the global economy—which encourages hoarding of money rather than its use for investment—one commentator pointed out that the “bitcoin community” can increase the supply of bitcoins through majority rule by jointly reprogramming the underlying software, which is publicly accessible. But if this is true, it means that bitcoin is controlled by a central bank after all, albeit one whose boardroom holds millions of people. The money supply is determined by votes cast by people who know nothing about monetary economics and little about the economic conditions that justify modification of it. So on what basis would they decide to increase the supply of the currency, and by how much? Also bad, the currency cannot be tailored to local conditions—a fatal defect under the optimal currency area theory of Nobel Laureate Robert Mundell. Greece, for example, is mired in a depression and sovereign debt crisis because the value of the currency it uses, the euro, is determined by the European Central Bank. The ECB chooses a money supply that reflects the economic conditions of the Eurozone as a whole, not Greece in particular. Under a global bitcoin currency, all countries would resemble Greece in the sense that they would be powerless to control the value of their currency.

The boring theory, which is a lot more plausible than the first, is that bitcoin holds promise as a payment system. A payment system enables a person to transfer currency to someone else where long distances prevent one from handing over the money palm to palm. Most people transfer money by writing checks, wiring it, or using a credit card (or PayPal, which relies on credit cards and bank accounts); that, in turn, requires intermediaries like banks, who effect transfers simply by deducting from one account and adding to another, while charging you a fee. Bitcoin avoids the intermediary. It’s as if you could insert a nickel into a slot in your computer, and then have it emerge from a slot in the computer of the person you are sending it to. Unlike banks, you pay no one for the service. Unlike PayPal, you leave no trace in your credit card records. If you live in a country with capital controls, you can avoid those as well.

Sounds attractive (especially to criminals), but the advantages of this system over current practice are not as obvious as they might seem. You need to trade your nickel for a bitcoin before you can send 5 cents of value over the Internet. You might instead keep some bitcoins handy (especially if you are a large business that continuously enters transactions), but then you take the risk that their price will plummet. If, instead, you buy a bitcoin every time you need to, then you must pay other people to bear the risk in the fluctuation of the value of bitcoins. People obtain bitcoins through bitcoin exchanges, and the exchanges take a cut in order to cover their costs, including the cost of protecting themselves and their users from fraud and other electronic mischief.

And this brings us to the problem of security. Bitcoin is touted as a super-secure form of payment. Let’s assume that it’s impossible for troublemakers to hack into the system itself and remotely delete people’s bitcoins or channel them into someone’s offshore account. The problem, as computer security experts know so well, is the human element. If I use bitcoins from my laptop or iPhone and carelessly disclose my password, then someone who gets ahold of my device will also get ahold of my bitcoins. And if my device is set up so I can easily buy bitcoins with my credit card, then the thief will be able to buy bitcoins up to my credit limit, move them to his own account, and get away scot-free. It is not hard to imagine armed robbers forcing people to buy bitcoins using their credit cards and hand them over, just as criminals today force people to withdraw from ATMs—the only difference being that ATM card withdrawal limits put a ceiling on the harm. The key security problem introduced by bitcoins is that bitcoin makes a huge amount of money available to people on devices that they carry around with them or leave unsecure in their homes and offices, and thus makes those people juicy marks for criminals.

Bitcoin owners can, of course, take precautions; one can imagine bitcoin institutions arising that offer bitcoin security and insure against loss or theft. But the more that people rely on these institutions, the more expensive it will be to use bitcoins, and the less anonymous bitcoin usage will be. Indeed, probably the only way to make bitcoin as secure and reliable as the existing payment system is to subject bitcoin exchanges and other institutional users to the law, reintroducing Leviathan just when we thought we could do without him. The theory that bitcoin allows us to avoid the government is just as upside down as the 1990s-era theory that the Internet allows us to avoid the government, when in fact it has made us more dependent on the government than ever, and more vulnerable to government abuse, as the NSA revelations have taught us. The advantage of bitcoins over other payment systems is as elusive as pseudonymous bitcoin inventor Satoshi Nakamoto. Maybe drug dealers and terrorism financiers will continue to see an advantage to bitcoin, but ordinary people may not.

If all this is true, why has the price of bitcoin breached $1,000? Last spring I speculated that bitcoin enthusiasm rested on ideological fantasy rather than economics, contributing in my own way to a bubble of bitcoin-skepticism. I no longer think this: Too much money has been invested into virtual currencies by gimlet-eyed investors who don’t give a whit about Ludwig von Mises. It is clearly possible that investors see a future in PayPal-like services that use bitcoin-related technology to transfer dollars, euros, and pesos hither and yon. This would explain why there is a boom in all virtual currencies, not just bitcoin.

The problem with the PayPal theory is that for ordinary (legal) consumers, the benefits of bitcoin scarcely distinguish it from existing payment systems, while the currency will remain scarily volatile. The real boon is for capital-control evaders, drug dealers, and terrorist financiers. If they, rather than legitimate businesses, are the real beneficiaries of the bitcoin phenomenon, then the government will bar legitimate institutions from the bitcoin market, eliminating its value for most users. Bitcoin will become another piece of malware floating about the net.