Central banking is not rocket science, but neither is it a trivial pursuit. Excellent books have continued to be written about the art and craft of central banking, from Walter Bagehot’s Lombard Street in 1873 to Alan Blinder’s Central Banking in Theory and Practice in 1998. Running a central bank is in one way a little bit like flying a plane or sailing a boat: much of the time standard responses and small adjustments will do just fine, but every so often a situation arises in which fundamental understanding, knowledge of history, and good judgment can make the difference between riding out the storm and crashing. There was no such person in charge in 1929, and the result was disaster. There was one in 2008.

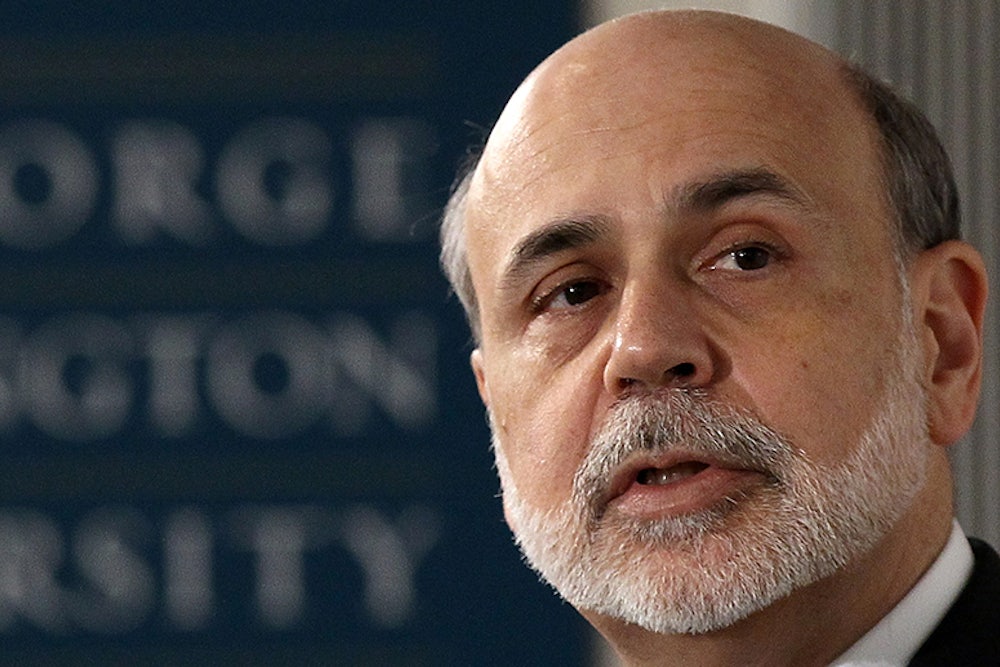

In his earlier scholarly life, Ben Bernanke, the chairman of the Federal Reserve Board, had been a careful student of the general interaction between the financial system and the real economy and especially of its working out in the Great Depression of the 1930s. So he had done his homework. His decisive and innovative actions at the Fed saved our economy from free fall with a possibly catastrophic end. I once non-joked that Bernanke was the Captain Kirk of central banking: he had loaned where no man had loaned before. In a life before turning to government service, first as a member of the Federal Reserve Board, then briefly as chairman of the Council of Economic Advisers, and then returning to the Fed as chairman in 2006, Bernanke was a well-known and highly respected academic economist. (The reader should know that I was one of his teachers in graduate school at MIT, and have remained a friend.) My opinion is that, after a briefly hesitant start as Fed chairman, probably still under the considerable aura of Alan Greenspan, Bernanke rose admirably to a difficult occasion and has been generally right in his judgments and his decisions, and in his willingness and his ability to explain both.

In March 2012, George Washington University invited Bernanke to give four lectures as part of a course devoted to the role of the Federal Reserve in the economy. The lectures are now reproduced in book form, apparently from lightly edited transcripts. Each lecture ends with half a dozen questions from anonymous “students” and Bernanke’s answers. Some of the questions are smart, some less so, in which case Bernanke exhibits the professorial skill of seamlessly answering a slightly different question. We are not told anything about the audience. I imagine a lot of people wanted to hear about the Federal Reserve and the financial crisis from the chairman himself. It’s rather like hearing Admiral Nelson reminisce about the battle of Trafalgar.

Whoever the listeners were, they were right to come. The lectures are consistently lucid and informal—maybe a little too anecdotal, but illustrated with many clear and informative slides—and above all intelligent and interesting. There are no revelations or recantations; even if Bernanke had any in mind, this would not be the place for them. A short book such as this has no room for a play-by-play account of the crisis. But it would be difficult to find a better short and not very technical account of what went wrong, and of how the Fed (and the Treasury) managed to keep it from getting much worse. Along the way Bernanke touches on a few delicate or unsettled issues having to do with the goals, the assumptions, and the methods of central banking.

In the five or six decades before the financial crisis, policy discussion inside and outside the Fed was largely concerned with monetary policy and the “dual mandate.” It is the statutory obligation of the Federal Reserve to try—using its main instrument, the capacity to influence or control short-term interest rates—to maintain both high employment and stable prices. (Many other central banks are instructed to focus only on price stability.)1 It is not easy to pursue two targets when you have only one instrument, one lever to pull, in this case the short-term rate of interest. To begin to see why, imagine a situation in which the unemployment rate is high, so the Fed would like to lower interest rates, but prices are rising too rapidly, so the Fed would like to raise interest rates. What helps with one goal hurts with the other. Another tool is needed. Some highly trained economists argue that such contradictory situations are impossible, to which the succinct rejoinder is: maybe on some other planet. Bernanke has no need to go down this road because this kind of contradiction did not arise during the crisis and its depressed aftermath, and the Fed has correctly kept interest rates very low.

Bernanke points out, in his first lecture, that the authors of the Federal Reserve Act of 1913 were not particularly focused on these issues at all. They were thinking mainly of a third mandate: the preservation of financial stability—basically the avoidance of banking panics like those that had occurred in 1873, 1884, 1890, 1893, and 1907. This is certainly historically correct. More importantly, it states a theme that resonates throughout the book and culminates naturally in the crisis of 2007–2008. So it is worth pursuing from first principles.

Those early financial panics were essentially epidemics of runs on banks. Think about what a bank does. It collects deposits, and in exchange it promises the depositors two things: an interest return on the money they have lent the bank (currently very low, but not necessarily so), and the right to withdraw in cash any part of the deposit-plus-interest at any time. The bank then uses the depositors’ money to make commercial and industrial loans to businesses, and perhaps to write home mortgages and other consumer loans. The bank earns a higher rate of interest on the loans it makes than it pays to depositors, and lives off the difference. But these are long-term loans—very long in the case of mortgages, and perhaps a year or more in the case of business loans.

How can a bank promise to pay depositors on demand when its assets—those loans—may not come due for months or years? Well, in the normal course of events the rate of net withdrawals is small and steady; the bank keeps a small cash reserve, uses it to pay depositors, and replenishes it from interest receipts and maturing loans, and that does the trick. Occasional large outflows can be met by borrowing temporarily from a large bank somewhere else. But suppose some depositors come to believe that the bank has made a bunch of bad loans. They will want to get their money out before it is too late. And as soon as the rest of the depositors sense what is happening, they, too, will want their money immediately. Nobody wants to be last in line and go home empty-handed.

But the bank cannot meet this mass demand (or “run”). Notice that, even if the initial belief is totally false and the fair value of the bank’s assets is easily enough to cover its deposit liabilities, the outcome is the same. The bank is solvent, but it is illiquid. Worse yet, if a solvent bank is forced into a distress sale of its assets in a desperate search for cash, it may have to dump them at such low prices that it becomes insolvent. And if this happens to one bank, the jittery depositors at other banks will be tempted into runs just to be on the safe side, and then it is even more likely that fundamentally sound banks will be driven to failure. Houston, we have a panic.

That problem has been solved—for banks. First of all, the Fed has essentially unlimited capacity to lend to banks against what it considers sound collateral, and it will do so to preserve the stability of the banking system. It is the “lender of last resort” to banks. And if it failed in its function, as it rather did in earlier days, Congress established the Federal Deposit Insurance Corporation (FDIC) in 1933.2 The FDIC collects a small tax on bank deposits—think of it as an insurance premium—and thus builds a fund with which it guarantees ordinary depositors against loss even if their bank fails. (Actually, only deposits below a certain generous size are covered, but this upper limit can be and has been changed to fit the circumstances.) Obviously, given these protections, there will be no runs on banks, because there is no reason for depositors to be nervous. In addition there is a complicated and unwieldy system of regulation: oversight bodies that are supposed to discourage or prevent banks from living dangerously.

So much for banks, or true depository institutions. A more general description of what banks do is “maturity transformation.” They incur short-term debt (deposits) and acquire longer-term, and therefore riskier, assets (such as loans to start-up businesses). This is a socially useful function: it enables savers who want instant access to their money to finance businesses that need to lock up capital for a long enough time to focus on the design, the production, and the marketing of a product. Human greed and ingenuity being what they are, a vast variety of financial institutions has been created to engage in maturity transformation and, analogously, risk transformation. They are not “banks,” so they are not regulated and overseen as banks have been, and they are not required to provide as much public information; but neither do they come under the protection of the FDIC or the lender-of-last-resort function of the Federal Reserve. And since they can be much more complex and opaque than banks, it may be hard even for relative insiders to know what may go wrong, or when, or exactly where.

This complexity and opaqueness matters more than you might think, and not just because they enable the well-informed to fleece the less well-informed. Two aspects are important. First, most of these non-bank financial institutions were very highly leveraged: their assets had been acquired almost entirely with borrowed money, and there was only a thin layer of owners’ capital supporting this leaning tower of sometimes risky assets.3 This meant that even a small gain on the large volume of assets would translate into a huge rate of profit on the small amount of equity capital invested; but it also meant that a small loss on those assets (or even a profit smaller than the interest cost of all that borrowed capital) would eat up the owners’ equity and leave the creditors facing possible default. Second, financial institutions had all borrowed and loaned to each other in ways that were not public.

So if A looked shaky, then B, C, and D, who might or might not have lent heavily to A, would perhaps not be repaid, in which case E, F, and G, who might be creditors of B, C, and D, were also possibly in trouble. The natural tendency in scary situations is to pull in whatever debts can be pulled in, and hunker down. The tendency of illiquidity to transform itself into insolvency is again at work. That all this happens in a fog of uncertainty only makes it worse. It is like a little old bank run, only on an enormous scale. A densely interconnected, highly leveraged financial system is intrinsically vulnerable to a collapse of this kind. And if it does implode, it is likely to drag the “real” economy with it as financing dries up for wage and salary payments, inventories, and materials.

What actually happened in 2008 and its aftermath was bad enough, and it is still going on, but it could have been worse had the Fed and the Treasury not stepped in as lender of last resort not just to banks but also to the whole financial system, and even beyond the financial system. The case of AIG is an example of a complex financial institution so strongly and opaquely interconnected with others that it had to be rescued, however distasteful that might be, for fear of the collateral damage that would be done by its failure. This is not to deny that AIG’s creditors, who were not exactly babes in the wood, might have been allowed to take some losses, just as a learning experience.

Perhaps the biggest tactical mistake of the rescue operation was the decision by the Fed and Treasury to let Lehman Brothers go bankrupt: not because the owners and creditors of Lehman deserved better, but because the collapse of Lehman seemed to intensify the panic dramatically. Bernanke says that he had no choice, because Lehman was insolvent. I am not convinced. Bernanke is very good on the significance of this experience, though necessarily brief. The lesson he teaches is that the Fed can no longer focus so near-exclusively on monetary policy. It, and the other regulatory agencies, have to pay more effective attention to that third mandate, the preservation of financial stability. He talks some about the new safeguards embodied in Dodd-Frank, generally with approval, although regulatory details still have to be fleshed out by the agencies themselves. He is diplomatically silent about the fact that the financial industry is lobbying fiercely to make sure that those regulatory safeguards are weak and permissive, and is making too much headway.

Another interesting issue emerges. A financial panic is set off by an event, a shock. The gunpowder that exploded in 2007–2008 was the collapse of the housing bubble, the unsustainable but nevertheless foolishly and persistently anticipated rise in house prices that supported so many exotic and risky securities. Bernanke remarks that, in terms of sheer magnitude, that initial shock was comparable to the bursting of the dot-com bubble in 2001. But nothing much happened then, at most a minor recession. How come? His answer is that the financial system had become more “vulnerable” in the intervening years. He has in mind the dangerous combination of leverage, complexity, and opaqueness already described.

His preferred answer is better and more system-oriented regulation. One has to ask then why regulation failed to see the crisis of 2007–2008 coming and take action to head it off. Bernanke suggests that regulators were lulled into inattention by the so-called Great Moderation: the fact that for almost a quarter-century after the mid-1980s, the American economy experienced fairly even-keeled growth, unmarred by financial disturbance. Our masters are all too eager to take the Panglossian view that a system of “free markets,” including financial markets, is self-regulating and self-stabilizing. Bernanke is surely right about this. The scholar of the 1930s has to be aware that there was similar talk about the New Era in the years before 1929. Dr. Pangloss has lots of helpers among the sharpshooters who profit most from the absence of effective oversight, and among simpleminded ideologues. They are still with us.

What about the possibility of cutting off the bubbles before they become dangerously large? It has often been proposed that the Fed should limit asset-price inflation in much the same way that it is committed to limiting goods-price inflation. In that view, the Fed should have choked off both the dot-com and house-price bubbles before they became large enough to do much damage. The usual counter-argument is that it is difficult to distinguish an asset bubble from a rise in price that is justified by “fundamentals.” There is something to that. If the Greenspan Fed had somehow quickly ended the boom in dot-com stocks, it would have been savagely beaten up by those who were profiting from the boom for having strangled the blue-sky industry of the future in its cradle. It is hard to imagine a definitive defense to the charge; the danger you have forestalled is nowhere to be seen.

A rather different counter-argument is that if the Fed is to undertake the prevention of asset-price inflation, it needs an added and appropriate instrument for doing so. A blunt tool, such as higher interest rates, won’t do at all: it may be enough to stop a bubble, but it may also precipitate a recession. In the case of a pure stock-market bubble, the imposition of higher margin requirements might be a good way to discourage speculation. Many large stock purchases involve only a fractional commitment of cash (the “margin”). The rest is borrowed, usually from the broker. The Fed has the power to require higher margins. Some speculators will be deterred. The rest can still take a loss, but they are losing more of their own money, with less danger to the financial system. The analog in more complicated bubbles would have to be some sort of graduated increases in capital requirements for participants, keyed to somebody’s estimate of the inherent risk and dangerousness of the “bubble” in question, as well as the likelihood that it is actually a bubble. One can imagine the flow of pious outrage from those who were looking to make a killing. This is a tough question, and no chairman of the Fed would want to muse about it in public.

For safeguarding financial stability in the future, Bernanke seems to count heavily on the provision in Dodd-Frank that establishes a committee of regulators charged with keeping an eye on “systemically important” financial institutions, whatever they look like, in order to warn them away from dangerously risky behavior and/or impose extra capital requirements. We will have to see how that works out: at a minimum there will need to be a workable definition of “systemically important” that takes adequate account of the ability of large financial institutions to take evasive action. And there will have to be a lot of international coordination and joint action.

Bernanke’s lecture on "The Aftermath of the Crisis" is something of a mopping-up. For those who have wondered, he justifies the massive asset-purchase programs of the Fed as a necessary extension of its traditional function as lender of last resort. The extension is necessary because we’re not in Kansas any more; the modern financial system now consists of a large and changing variety of institutions, buying and selling a large and changing variety of assets, doing a lot of maturity transformation and poorly understood risk transformation, and generating much more volatility than old-fashioned banks ever could. He says a little about the methods that the Fed will use to shrink its balance sheet when the economy has finally recovered. This is unexplored territory, but it is clear that the Fed has thought its way through the process, and I am not inclined to pontificate.

I am more interested in Bernanke’s take on why the recovery from the deep recession has been so agonizingly slow. According to the expert committee of the National Bureau of Economic Research that pronounces on such things, the recession ended in June 2009. An upswing of sorts began. Almost four more years have gone by, and output and employment have risen, but not much, not nearly enough. In the words of a favorite song from South Pacific: “What don’t we feel? We don’t feel good.”

Bernanke puts most emphasis on the fact that the homebuilding industry is still stumbling along at not much more than half its normal level of production. Along with construction itself, the various accessory industries (furniture, appliances, heating, cooling) suffer from weak demand for their products. There is no puzzle here. The house-price bubble induced an overproduction of houses, maybe a couple of million of them. The bubble may be gone, but the houses are still there, diminishing the demand for new construction. Add to them the vacancies created by foreclosures, for which insufficient and unimaginative public policy is partly to blame, and it is no wonder that the housing industry is struggling and weighing down the rest of the economy, even with extraordinarily low mortgage rates. Bernanke also points to the fact that the stagnation or even recession of the European economy, caught in both its own financial problems and its suicidal adoption of austerity policies at exactly the wrong moment, acts as a drag on our own economy. Usual export markets are weaker, and the competition from imports is stiffer.

I think Bernanke could have made more of the evaporation of paper wealth during the financial meltdown. The stock market has made up much of the lost ground; but even so, a lesson about the volatility of asset prices and the precariousness of paper wealth must have been absorbed. It is very likely to inhibit consumer spending and perhaps also business investment for some time. The general process of de-leveraging, the reduction of debt burdens, is still going on at the expense of current spending. I wonder if researchers at the Federal Reserve Board have tried to estimate the effect of the continuing increase in income inequality on consumer spending (on domestically produced goods and services). Extremely high incomes are apparently still dominated by financial pay packages while median income stagnates. A few big spenders may not be enough to keep industry going if the mass market has no steam behind it. This is a legitimate part of Bernanke’s broad agenda: widening inequality has other sources besides the otherworldly compensation packages in finance,

but that is certainly part of the problem.

He touches on it only obliquely in these lectures, but Bernanke has lingering worries that the size, the complexity, and the interconnectedness of today’s financial system strain the capacity of even improved risk-management techniques to protect the system against its inherent vulnerabilities. We have probably not seen the last occasion when a financial institution that is too big to fail is about to fail. Dodd-Frank has authorized a process in which the regulatory bodies can in principle allow failure, conduct a quick and controlled bankruptcy, wipe out the equity, and inflict appropriate losses on the creditors without serious disruption of useful financial activity. The process may work reasonably well; we won’t know until it happens. And we can be sure that the financial lobby will be throwing its weight around on the side of laxness.

All of which leads to a broader issue that Chairman Bernanke could not possibly mention in these lectures or elsewhere, but that I wish Professor Bernanke would think about whenever he leaves office. Any complicated economy needs a complicated financial system: to allocate dispersed capital to dispersed productive uses, to provide liquidity, to do maturity and risk transformation, and to produce market evaluations of uncertain prospects. If these functions are not performed adequately, the economy cannot produce and grow with anything like efficiency. Granted all that, however, the suspicion persists that financialization has gone too far.

What would that mean? It would mean that the last x percent of financial activity absorbs more resources (especially intellectual resources) and creates more potential instability than its additional efficiency-benefits can justify. This charmingly subversive suggestion is easy to make, but it is extremely difficult to validate. Yes, it is hard to imagine that the Hedge Fund Operator of the Year does anything that is remotely socially useful enough to justify the enormous (and lightly taxed) compensation that results; but that is not really an argument. Much more significant is the fact that the bulk of incremental financial activity is trading, and trading, while it may provide a little useful public information about market opinion, is largely a way to transfer wealth from those with inferior information and calculation ability to those with more. There is no enhancement of economic efficiency to speak of. This is, you might say, the $64 trillion question. Maybe I shouldn’t wish it on Ben Bernanke.

Robert M. Solow is Institute Professor of Economics emeritus at MIT. He won the Nobel Prize in Economics in 1987.

This is notably true of the European Central Bank, although Mario Draghi may lean a bit in the Fed's direction.

For a long time, borrowing from the Fed was treated a a sign of bad behavior by the borrowing bank. The Bernanke Fed had to change this.

Leverage ratios of 30 to 1—$30 billion of assets for $1 billion of equity—were not rare. A little more than a 3 percent loss on the assets would wipe out the owners and begin to hit creditors.